It is a RBI initiative that enables SMEs (Small & Medium Enterprises) to discount their trade receivables with corporate buyers through various financiers. This mechanism aims to improve the trade receivable management of SMEs. The system has significantly enhanced the competitiveness of SMEs by addressing their critical working capital needs by providing easy access to funds, competitive discounting rates, fully digital process and seamless data flow. It empowers stakeholders with its 24 hrs TAT, 100% trust, transparency, digital flows and easy accessibility.

TReDS is a digital platform designed to enhance working capital management for MSMEs by enabling invoice discounting. Here are some key features of TReDS:

Seamless Digital Process: Platforms like M1xchange TReDS offer a fully digital experience, where businesses can register and manage invoices online through the TReDS portal.

Easy Registration: MSMEs, corporate buyers, and financiers can complete TReDS registration online, providing access to a network of financiers.

Invoice Discounting: MSMEs upload invoices on the TReDS platform, and once approved by the buyer, financiers offer competitive rates to discount the invoices.

Transparency & Security: The process is transparent and regulated by the RBI, ensuring a secure and efficient environment for all participants.

Quick Cash Flow: TReDS login enables MSMEs to access immediate funds against unpaid invoices, enhancing liquidity without taking on additional debt.

Overall, TReDS platforms in India provide a robust solution for businesses to optimise cash flow and streamline trade receivable management.

Trade Receivables Discounting System offers several key features designed to streamline financial processes for businesses. It provides non-recourse financing, which means that the financier assumes the risk of non-payment by the buyer, reducing the burden on the seller. Additionally, TReDS operates on a non-collateral basis, eliminating the need for physical assets to secure funding. The system promotes transparency and trust by ensuring that all transactions are conducted openly and can be easily monitored. Furthermore, TReDS is fully digital, enabling efficient and paperless processing of trade receivables, enhancing convenience and speed for all parties involved.

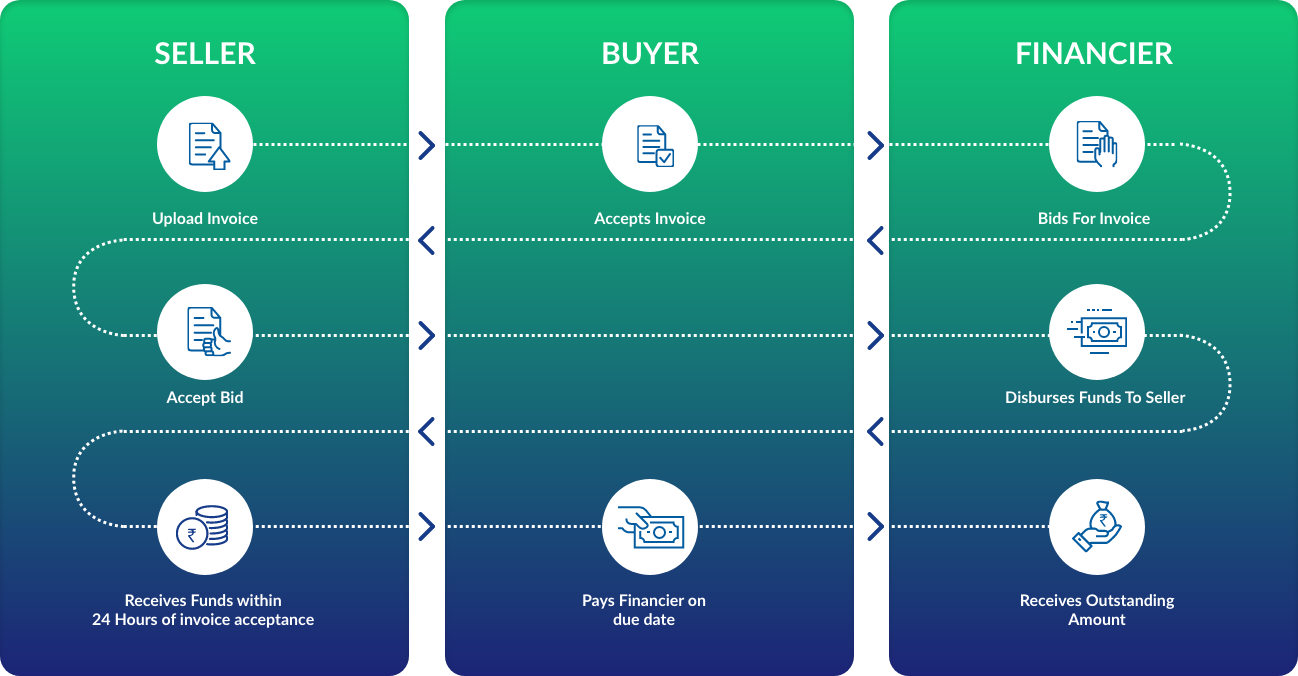

Transactions on TReDS platform are conducted digitally and start when the SME supplier of goods & services raises the invoice, and the buyer validates the same. This permits the financiers (Banks/ NBFCs) to bid against the verified and approved invoice. Once the supplier accepts the bid, payment is processed in 1 day and credited to the SMEs bank account.

SMEs upload their invoices onto the TReDS platform

Corporate buyers review the uploaded invoices and accept or reject them based on their validity and terms

Financial institutions, such as banks and non-banking financial companies (NBFCs), can bid on the discounted invoices

Once an SME accepts a bid, the financial institution pays the discounted amount directly to the SME's account

On the due date, the corporate buyer settles the invoice with the financial institution

Benefits

Small-to-Small (S2S) is a deep-tier financing system introduced by M1xchange under the aegis of the RBI to extend the benefits of invoice financing to the entire spectrum of SMEs. Powered by a cutting-edge credit risk evaluation engine, S2S Financing evaluates businesses, fostering financial hygiene and rewarding growth-oriented enterprises.

The S2S Flow outlines the operational process for Small-to-Small transactions

The process begins when an SME (acting as a buyer) initiates a transaction by submitting receivables from Tier-2 or Tier-3 suppliers onto the platform. These suppliers can now seek early payment by discounting their receivables.

The receivables submitted are verified by the buyer (the SME), ensuring they are legitimate and accurate. This verification is essential for maintaining the integrity of the transactions.

Once verified, the receivables are available for discounting by financiers on the platform. Suppliers can access funds by selling their receivables at discounted rates, thus receiving early payment.

Once verified, the receivables are available for discounting by financiers on the platform. Suppliers can access funds by selling their receivables at discounted rates, thus receiving early payment.

The Nigeria Story

The M1 TReDS platform has successfully facilitated the disbursement of a cumulative 120 billion Naira in business funding to small and medium-sized enterprises (SMEs) across the country. This achievement underscores the platform’s effectiveness in bridging the financing gap faced by SMEs, providing them with timely access to affordable capital. The 120 billion Naira disbursed represents a substantial boost to the Nigerian economy, supporting job creation, entrepreneurship, and overall economic growth.

Ans. TReDS is an RBI-regulated platform that allows MSMEs to get their invoices discounted by financiers, ensuring quick access to working capital. Platforms like M1xchange TReDS provide a seamless TReDS online experience where MSMEs can complete TReDS registration online, upload invoices via the TReDS portal, and receive upfront payment. Once invoices are approved by corporate buyers, financiers on the TReDS platform bid to offer the best discounting rates. MSMEs benefit by improving cash flow without incurring debt, while buyers and financiers can manage their receivables efficiently. TReDS platforms in India help MSMEs manage liquidity and grow their businesses.

Ans. TReDS platforms in India, such as M1xchange TReDS, allow three types of participants:

All participants can access the platform via their TReDS login, ensuring secure and efficient management of invoices and working capital. TReDS online facilitates seamless interaction between sellers, buyers, and financiers for smooth financial transactions.

Ans. TReDS is a digital platform that helps MSMEs get immediate access to working capital by discounting their invoices. Through platforms like M1xchange TReDS, MSMEs can complete TReDS registration online, upload invoices on the TReDS portal, and secure upfront payments. Once corporate buyers approve the invoices, financiers on the TReDS platform offer competitive rates to discount the invoices. MSMEs benefit by improving liquidity without taking on debt, allowing them to manage cash flow effectively. TReDS platforms in India enable a seamless, transparent process, enhancing financial inclusion for MSMEs and supporting their growth.

Ans. On TReDS platforms in India, such as M1xchange TReDS, the interaction between sellers, buyers, and financiers is streamlined through a digital process.

This seamless interaction on the TReDS platform ensures faster processing and transparent financing.

Ans. To register on TReDS platforms in India like M1xchange TReDS, the following eligibility criteria apply:

Ans. The discounting process on TReDS platforms in India, such as M1xchange TReDS, works as follows:

The process is managed securely through TReDS, providing a seamless, efficient, and transparent invoice financing solution for all participants.

Copyright © 2024 Mynd Solutions Pvt. Ltd. All Rights Reserved.