Despite their importance, many MSMEs remain small-sized and unable to scale up effectively due to various challenges, with access to affordable finance being one of the barriers, said RBI’s Shaktikanta Das.

Despite their importance, many MSMEs remain small-sized and unable to scale up effectively due to various challenges, with access to affordable finance being one of the barriers, said RBI’s Shaktikanta Das.

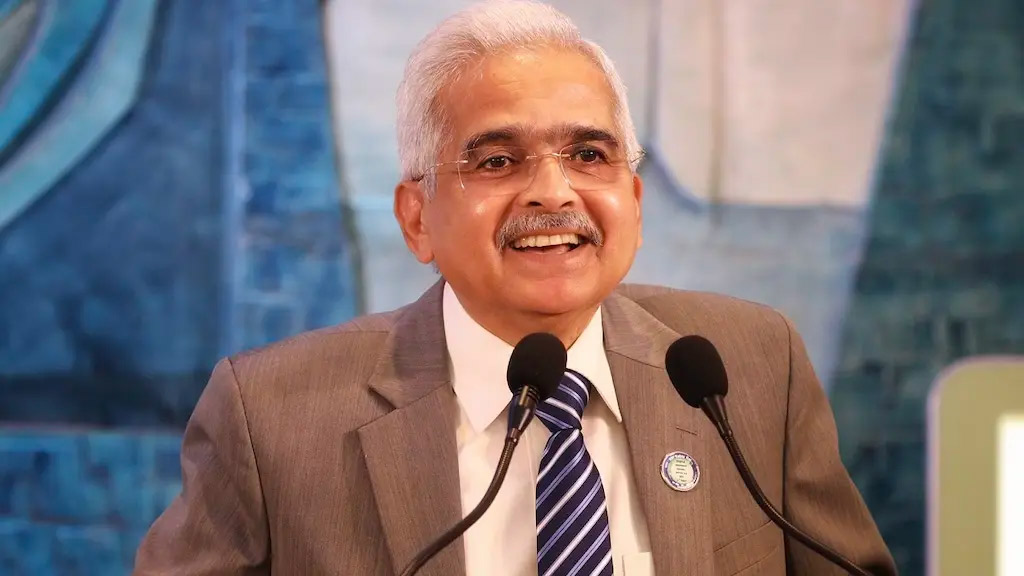

Reserve Bank of India (RBI) Governor Shaktikanta Das on Thursday suggested banks and financial institutions develop tailored financial products and services specifically for MSMEs to address the credit barrier to growth. Addressing the annual FIBAC conference by FICCI and Indian Banks’ Association (IBA) in Mumbai, the governor suggested “flexible credit options, improving access to working capital, and providing financial support that accommodates the unique cash flow cycles and growth stages of MSMEs.”

“This can propel MSMEs to expand, enhance their productivity, and contribute more significantly to job creation,” Shaktikanta Das said.

The governor noted that with India’s large young population, it needs to fully tap the potential of MSMEs to drive employment and economic development.

Despite their importance, many MSMEs remain small-sized and unable to scale up effectively due to various challenges, with access to affordable finance being one of the barriers, he added.

Das also highlighted the need for growing women entrepreneurship in the country as “less than one fifth of MSMEs are owned by women.”

Underscoring the challenges faced by women entrepreneurs such as limited access to capital, restrictive societal norms, and difficulties in accessing affordable finance, the governor said the financial sector has a crucial role to play in bridging this gender gap by implementing supportive policies, creating tailored financial products, and leveraging fintech innovations to offer better access to finance.

This, Das said, can be pursued on two fronts: first, by providing higher employment opportunities to women in financial institutions; and second, by supporting women entrepreneurs, through government-sponsored schemes as well as banks’ own schemes tailored to suit businesses promoted by women.

He suggested that banks could also actively explore onboarding larger number of women business correspondents, especially from among self-help group (SHG) members.

Last week, Das at an event had announced the RBI’s upcoming Unified Lending Interface (ULI) – a UPI-like lending platform to boost credit access to MSMEs.

“The commencement of the Reserve Bank’s pilot project for frictionless credit, i.e. the end-to-end digital platform of the Unified Lending Interface (ULI) is expected to revolutionise access to credit, especially for farmers and MSMEs,” Das said.

The platform was announced by the central bank in August last year as an end-to-end digital platform with an open architecture, open Application Programming Interfaces (APIs) and standards, to which all financial sector players can connect seamlessly.