Priority sector lending

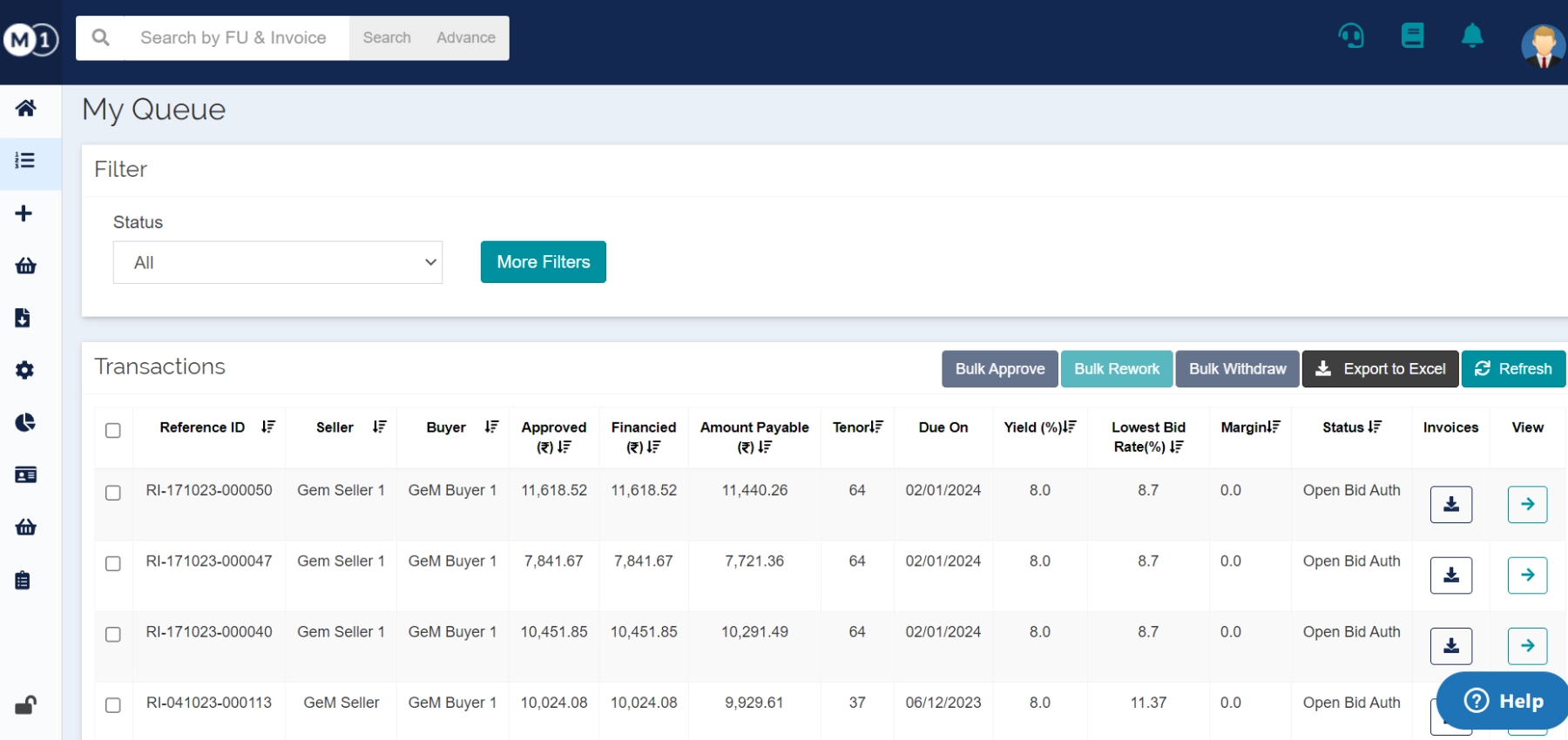

Readymade business opportunities

Significantly lower overhead costs

PAN India coverage

Any existing NBFC-ICC intending to undertake factoring business shall make an application to the Reserve Bank for grant of CoR under the Act if it satisfies the following eligibility criteria:

Type the name of your Bank/NBFC to check whether you qualify under the RBI guidelines to participate. Any corporate with >Rs. 500 crore turnover has to mandatorily register on TReDS.

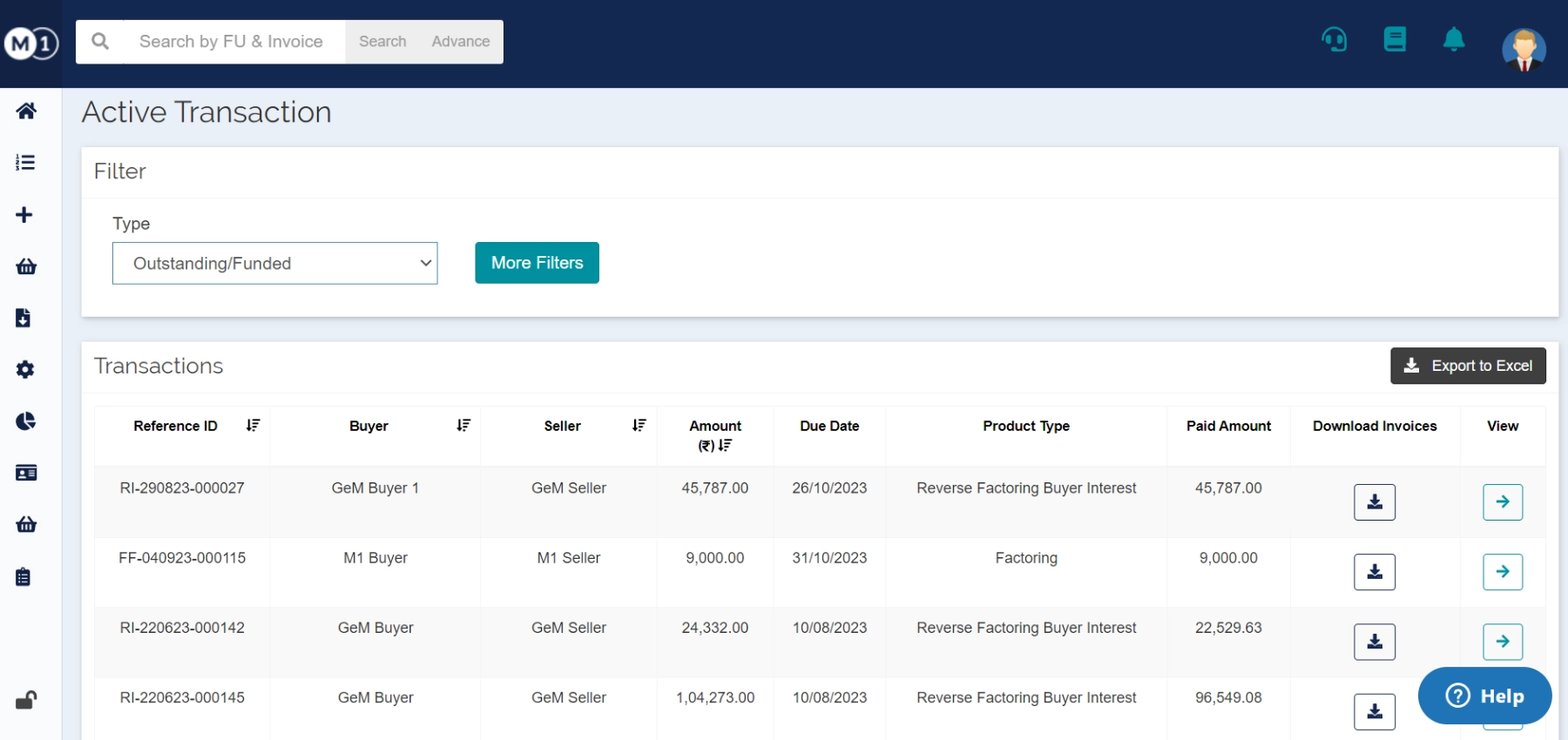

Factoring in finance is a transaction where a company sells its accounts receivable to a third party at a discount.

In factoring the factor advances the business cash by collecting payment from corporates, known as buyers who owe it and then turning over that money to the MSMEs, known as sellers or vendors.

In financial risk, factoring refers to the risk associated with the purchase of accounts receivable (invoices) from a business by a third-party financier, known as a factor. The factor assumes the risk of non-payment by the customers who owe the receivables, which can result in losses if the customers do not pay their invoices.

Non-recourse factoring is beneficial for MSMEs as it transfers the risk of non-payment to the factor, providing protection against bad debts. Additionally, advance factoring can provide immediate cash flow, helping MSMEs to meet their working capital requirements.

Factoring can be considered an asset for the company selling its accounts receivable, as it generates cash inflow. From the perspective of the third party buying the accounts receivable, factoring can be considered a liability, as it represents a financial obligation to pay the company for the accounts receivable it has purchased.

Get in touch to discover the benefits of M1xchange.

Copyright © 2024 Mynd Solutions Pvt. Ltd. All Rights Reserved.