Through M1xchange TReDS, registered MSMEs acting as buyers can approve invoices raised by other MSMEs, allowing financiers to discount them via the TReDS Portal. This innovative approach strengthens supply chain partnerships, improves cash flow, and promotes inclusive growth. Sellers benefit from timely access to funds, while MSME buyers enhance MSME vendor trust without straining their own liquidity.

By digitising and streamlining bill discounting, TReDS makes working capital management more efficient, especially for businesses in Tier 2 and Tier 3 cities. Small-to-Small financing on M1xchange TReDS ensures a seamless, RBI-regulated environment where trust, transparency, and timely payments drive collective progress across the MSME ecosystem.

M1xchange introduces this innovative concept, offering a digital haven for MSMEs to flourish. Unlike conventional TReDS, RBI-licensed S2S extends the benefits of invoice financing to the entire spectrum of MSMEs, facilitating early cash flows in business and creating a level playing field. This Deep-Tier Financing is unsecured in nature, comes at a low cost, and is brought to you with the power of digital. It being off-balance-sheet financing disrupts the norm, providing a seamless platform where MSMEs can securely receive early payments.

Powered by a cutting-edge credit risk evaluation engine, S2S Financing evaluates businesses, fostering financial hygiene and rewarding growth-oriented enterprises. It's not just financing; it's a limitless journey through the spheres of speed, accessibility, and scalability—a rewarding saga approved by the RBI, accessible to every corner of India.

Welcome to S2S Financing, where dreams know no limits!

Empowers MSMEs without requiring collateral, fostering accessibility to a broader range of businesses.

Minimizes the impact on financial statements, allowing MSMEs to maintain a healthier balance sheet.

The platform effect brings in the opportunity of availing financing at a very competitive and affordable Interest rates.

Extends financial support throughout the supply chain, ensuring comprehensive assistance beyond the immediate transaction.

Promotes growth without financial constraints, offering MSMEs the freedom to pursue ambitious ventures.

Utilizes a sophisticated credit risk engine to evaluate businesses, encouraging financial hygiene and discipline.

Ensures regulatory compliance and approval by the Reserve Bank of India, instilling trust and confidence.

Provides a seamless and scalable digital platform, enhancing speed, accessibility, and ease of use for MSMEs.

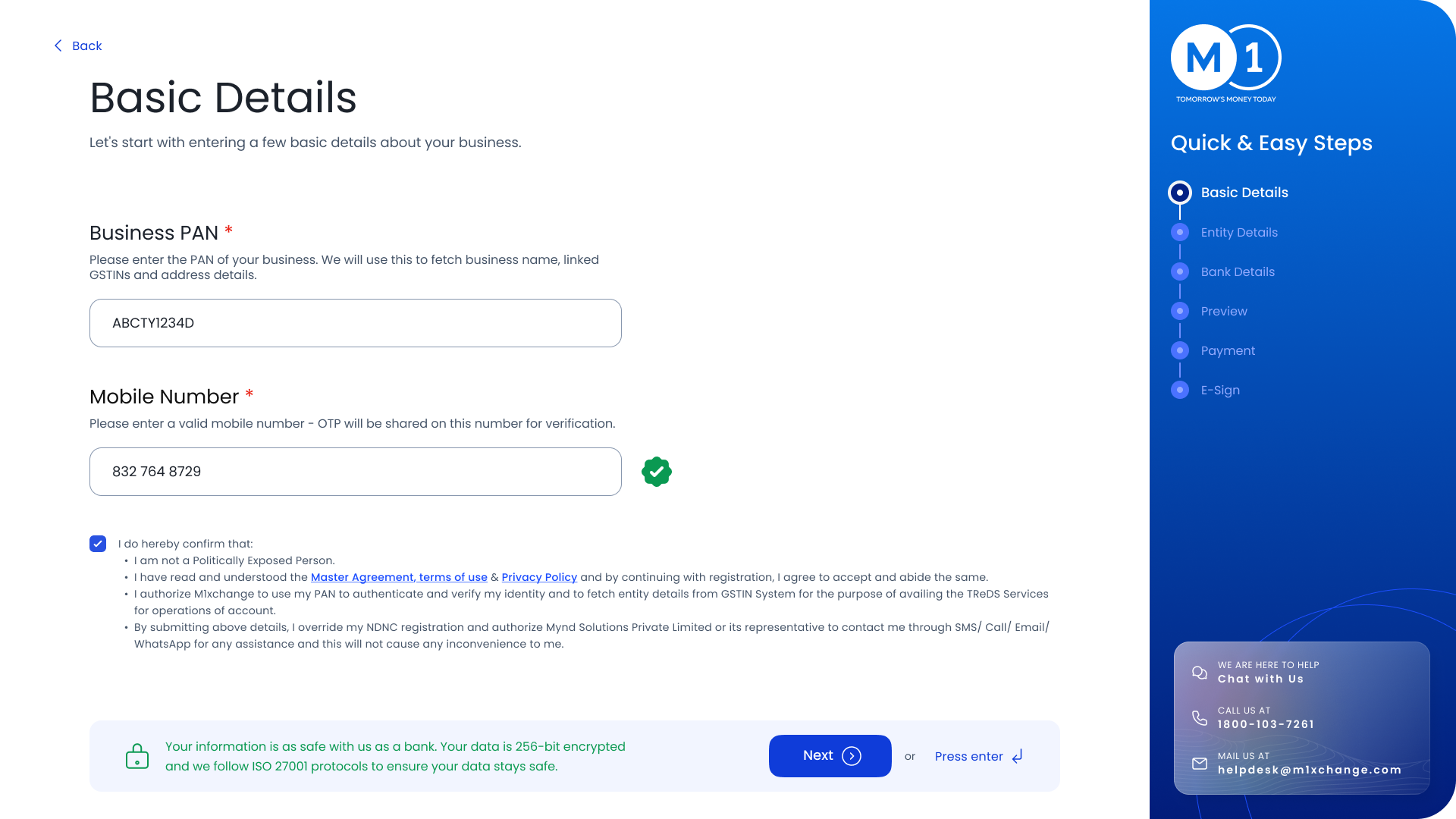

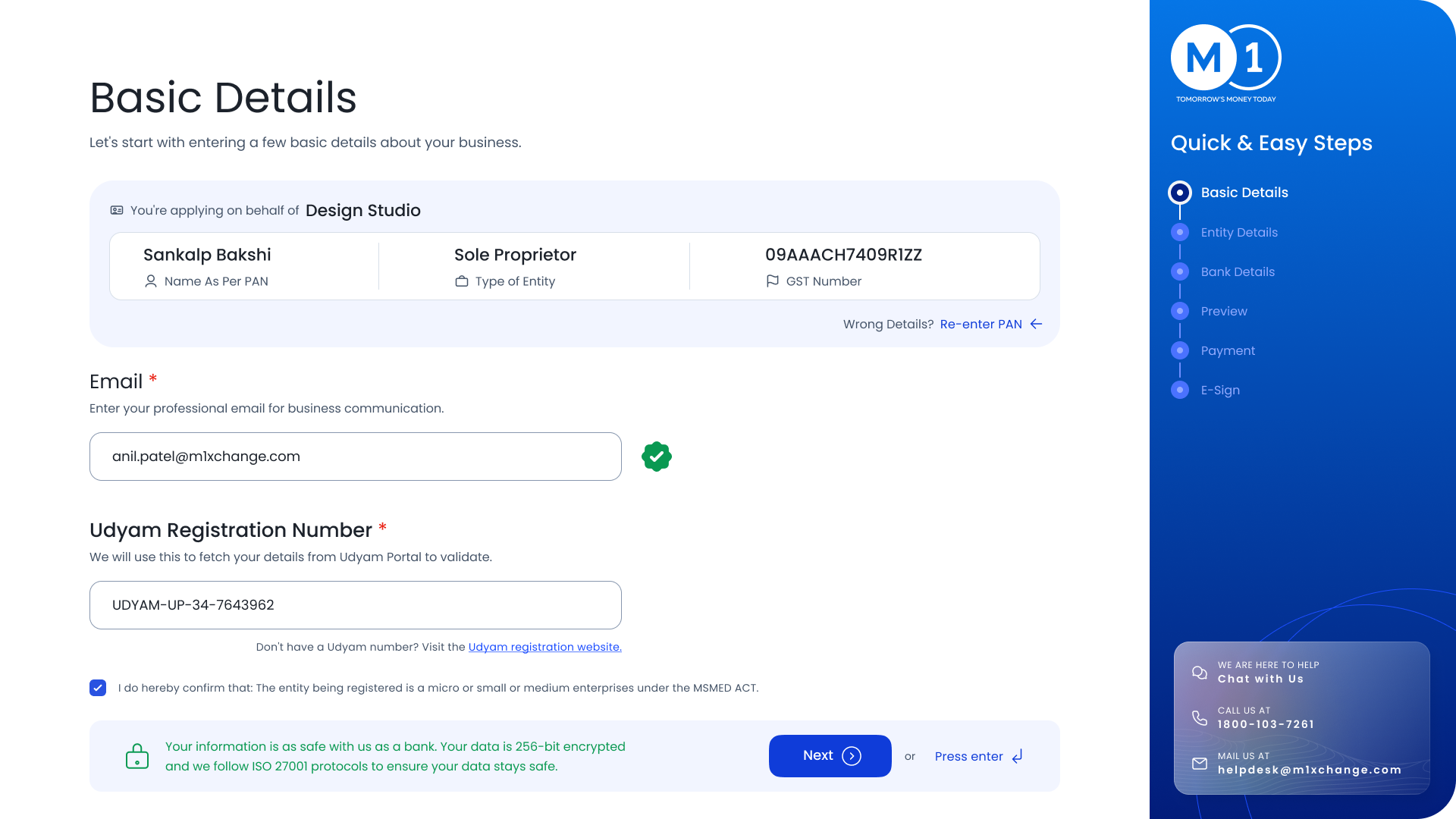

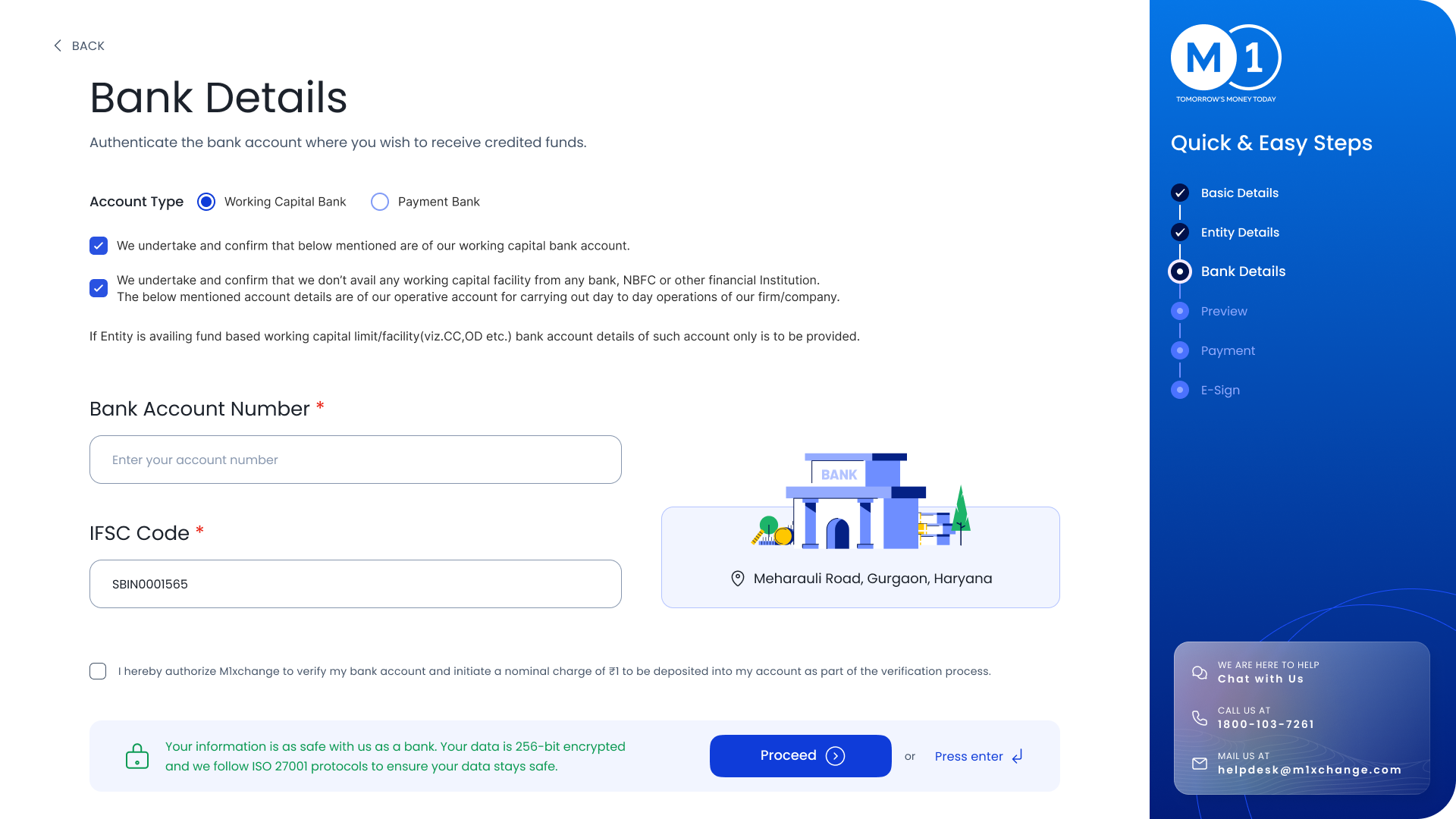

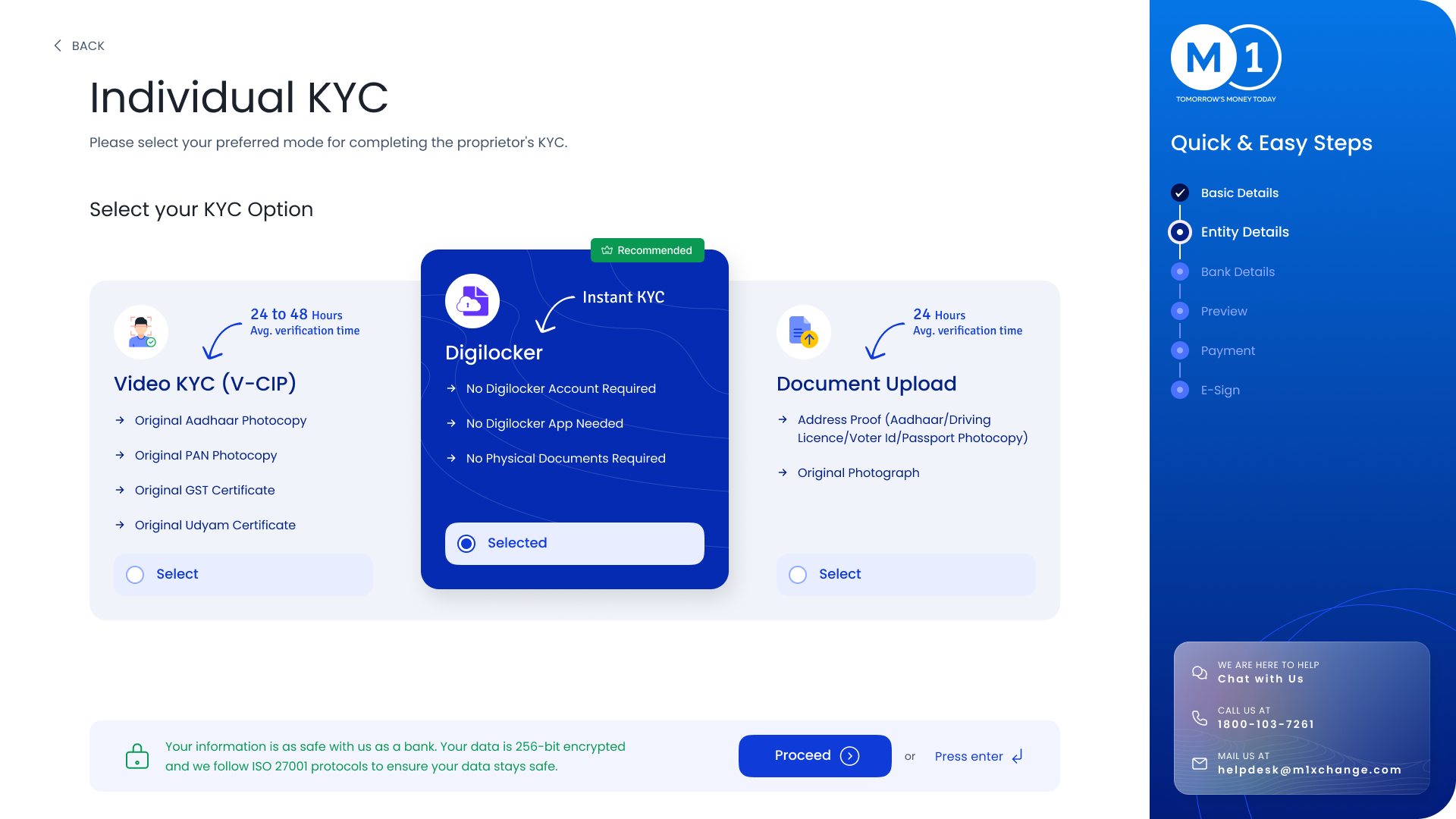

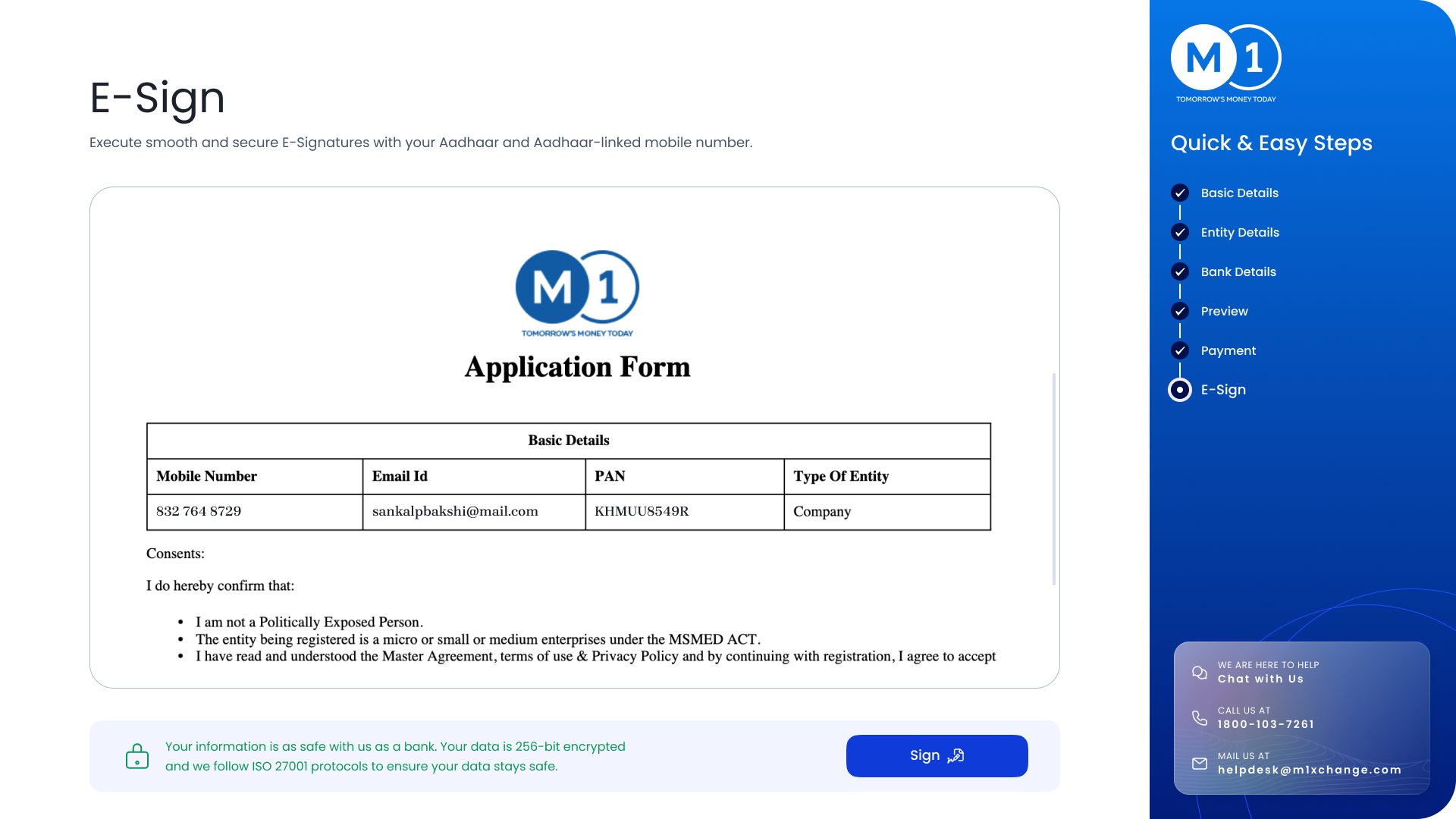

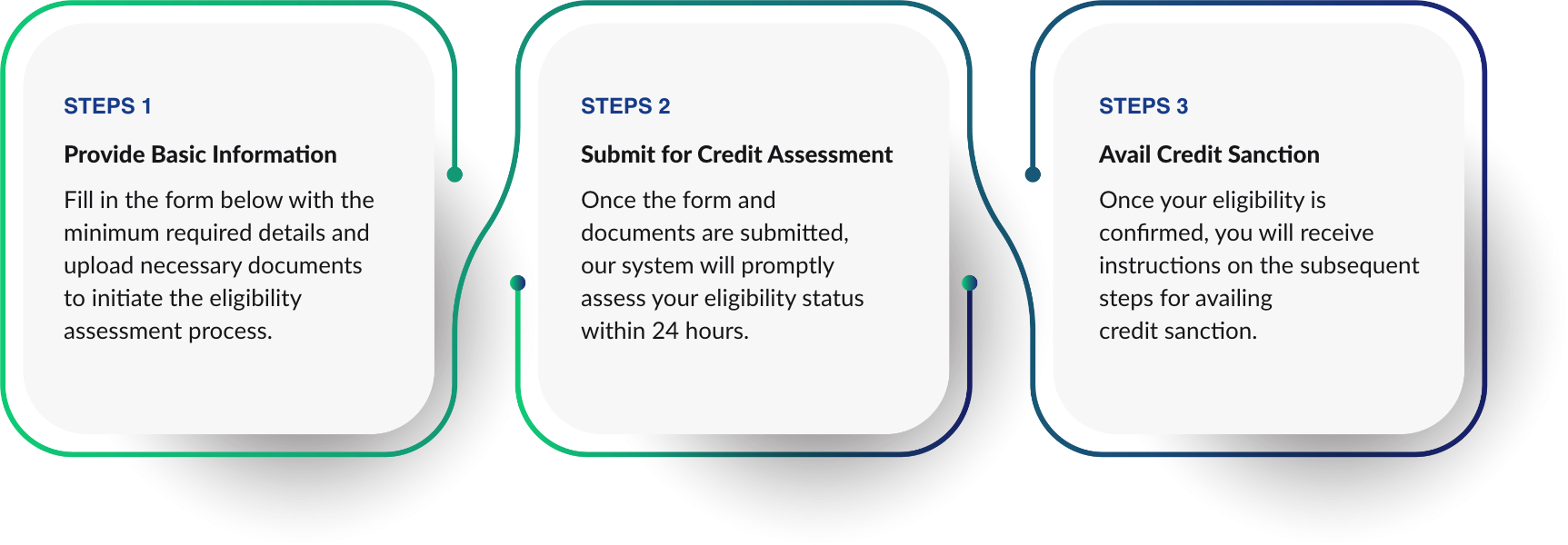

Digital onboarding process, including eKYC, video verification, e-agreement signing, documents submission, etc., is fast and convenient. The experienced team provide timely and abled support to fast track it.

Through a credit analytics engine (CAE), the model offers digital credit assessment of MSMEs that leverages data available from multiple online data sources such as bank statements, GSTN, TReDS transaction data, etc.

Based on the approval of the transactions, the approved funds are disbursed to the vendors, providing them with quick access to working capital for their operations.

Buyer repay the funds when the payment is due, creating a seamless and mutually beneficial financial cycle.

“Small-to-Small (S2S)” financing is a digital invoice discounting model that enables MSME buyers to support MSME sellers with early payments. Through the TReDS Platform, particularly M1xchange TReDS, MSME buyers can approve supplier invoices, which are then financed by registered financiers. This process boosts cash flow for sellers without impacting the buyer’s liquidity. S2S financing is fully digital and RBI-regulated, operating seamlessly on the TReDS Portal. It brings the benefits of traditional bill discounting to smaller businesses, strengthening vendor relationships and improving working capital management across the MSME value chain.

To participate in Small-to-Small financing on the M1xchange TReDS Platform, MSMEs must be registered under the MSMED Act and have an active GSTIN. They should be buyers or sellers of goods/services and able to provide valid, approved trade invoices. Access to the TReDS Portal requires successful TReDS Registration. Both parties must undergo KYC verification. Once approved, MSMEs can log in via the TReDS Login and begin transactions. This digital process ensures that even smaller businesses can access the benefits of bill discounting, improved cash flow, and better working capital management.

To onboard an MSME for Small-to-Small financing on the TReDS Platform, general KYC and business verification documents are required. These typically include proof of identity, GST details, business PAN, and bank account information. The documentation ensures regulatory compliance and financial transparency. On M1xchange TReDS, the process is fully digital through the TReDS Portal, making TReDS Registration Online fast and secure. After KYC approval, MSMEs gain access to TReDS Login and can begin discounting invoices. For the complete list of required documents, please refer to the list here: [https://www.m1xchange.com/wp-content/uploads/2025/05/KYC-Documents-Requirement-List-1.pdf ]

MSME sellers benefit from faster access to funds through early invoice payments on the TReDS Platform, improving cash flow and reducing reliance on loans. Buyers, even if they are MSMEs, can support vendors without impacting their own liquidity. M1xchange TReDS facilitates this digital process with full transparency, competitive financing rates, and secure transactions. Through bill discounting on the TReDS Portal, both parties enhance their working capital management and build stronger supply chain partnerships. Small-to-Small financing empowers businesses to grow sustainably while maintaining healthy financial practices via TReDS Online.

An eligible buyer is an existing M1xchange vendor with a history of activity in the last 6 months. The vendor should be an MSME with a turnover ranging from > Rs. 5 crore to less than Rs. 250 crore.

Interest rates range from 11% to 14% p.a., varying among banks. Processing fees fall between 1% and 2%, contingent on the sanctioned limit.

Credit limits are sanctioned based on documents, bank statements, and consent for GST and CIBIL data provided during onboarding. M1xchange facilitates the limit sanctioning process using an in-house credit analytics engine.

Limits can be sanctioned from Rs. 10 lakhs to a maximum of Rs. 100 lakhs. Financiers may consider higher limits based on their comfort.

Documents needed are those collected during TReDs onboarding, including additional bank statements, GST data via OTP, CIBIL data with consent, and audited financial reports for the last 2 years. The sanctioning process may take up to 5 working days once all lender documentation is complete.

Yes, the process mirrors TReDs, covering onboarding, transactions, funding, and settlement. Each buyer is associated with one financier for funding transactions on the TReDs platform.

The maximum credit period offered is up to 60 days. Banks may consider extending it to 90 days if deemed comfortable with the buyer.

Copyright © 2024 Mynd Solutions Pvt. Ltd. All Rights Reserved.