M1xchange introduces this innovative concept, offering a digital haven for MSMEs to flourish. Unlike conventional TReDS, RBI-licensed S2S extends the benefits of invoice financing to the entire spectrum of MSMEs, facilitating early cash flows in business and creating a level playing field. This Deep-Tier Financing is unsecured in nature, comes at a low cost, and is brought to you with the power of digital. It being off-balance-sheet financing disrupts the norm, providing a seamless platform where MSMEs can securely receive early payments.

Powered by a cutting-edge credit risk evaluation engine, S2S Financing evaluates businesses, fostering financial hygiene and rewarding growth-oriented enterprises. It's not just financing; it's a limitless journey through the spheres of speed, accessibility, and scalability—a rewarding saga approved by the RBI, accessible to every corner of India.

Welcome to S2S Financing, where dreams know no limits!

Empowers MSMEs without requiring collateral, fostering accessibility to a broader range of businesses.

Minimizes the impact on financial statements, allowing MSMEs to maintain a healthier balance sheet.

The platform effect brings in the opportunity of availing financing at a very competitive and affordable Interest rates.

Extends financial support throughout the supply chain, ensuring comprehensive assistance beyond the immediate transaction.

Promotes growth without financial constraints, offering MSMEs the freedom to pursue ambitious ventures.

Utilizes a sophisticated credit risk engine to evaluate businesses, encouraging financial hygiene and discipline.

Ensures regulatory compliance and approval by the Reserve Bank of India, instilling trust and confidence.

Provides a seamless and scalable digital platform, enhancing speed, accessibility, and ease of use for MSMEs.

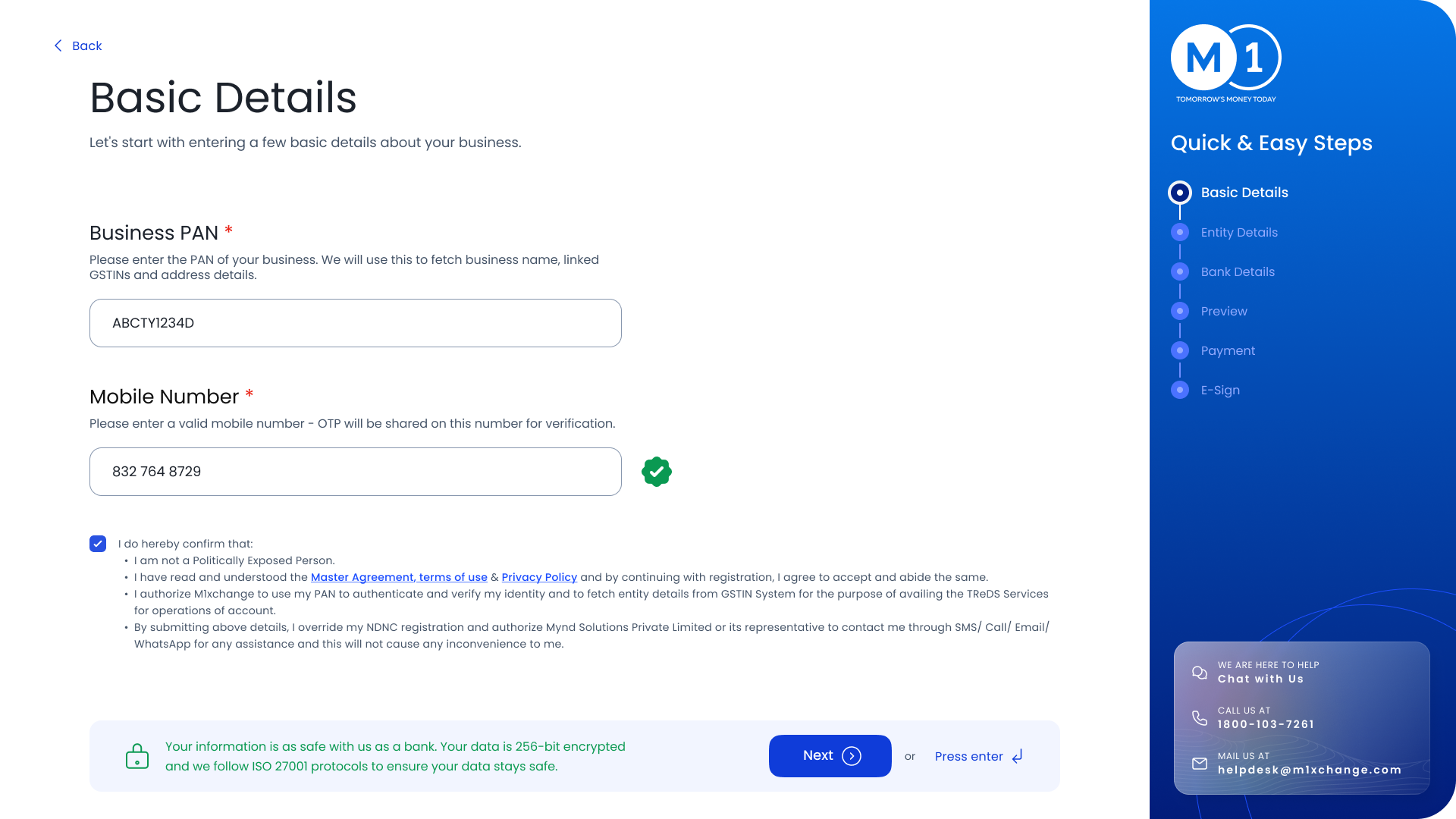

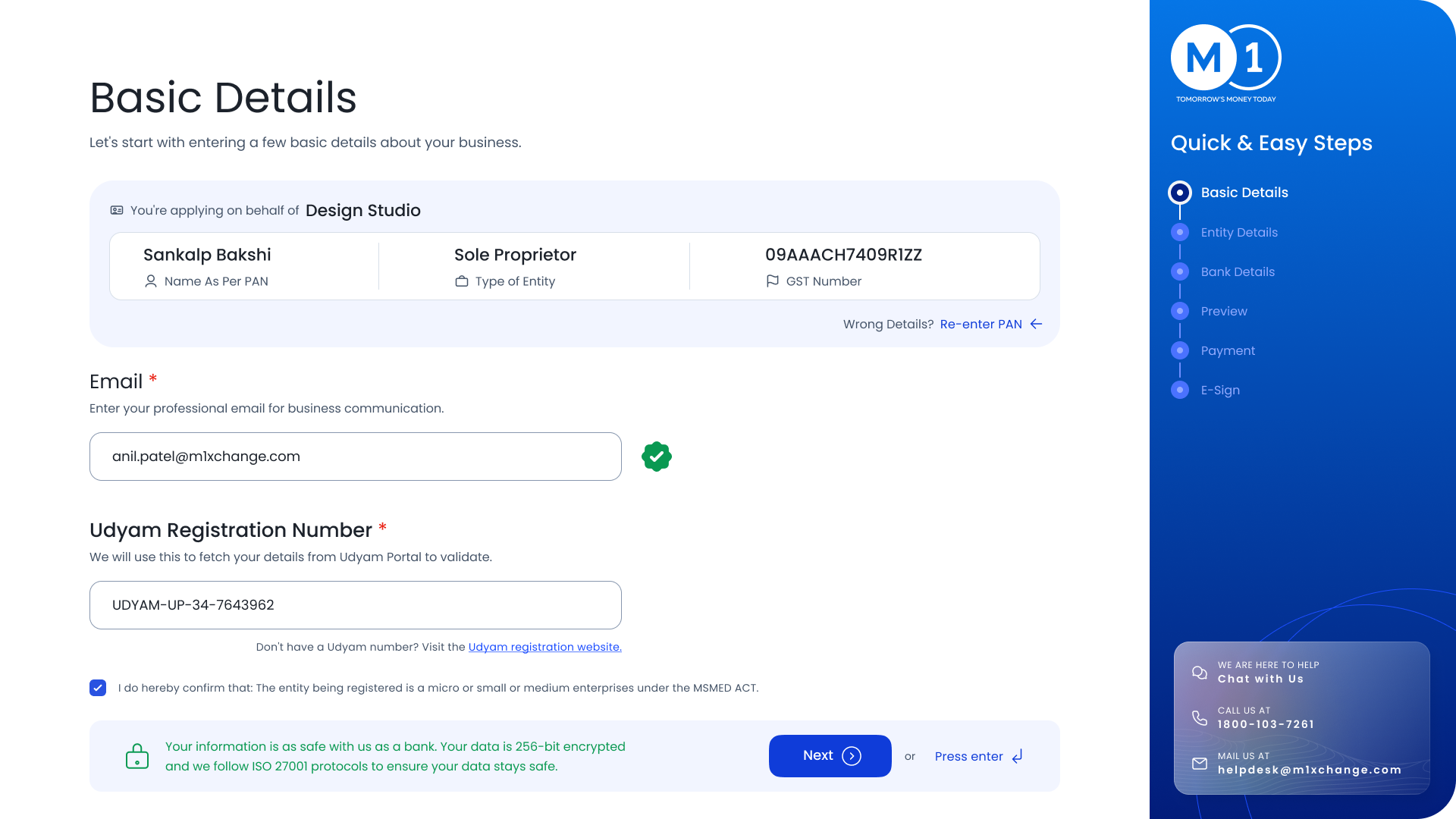

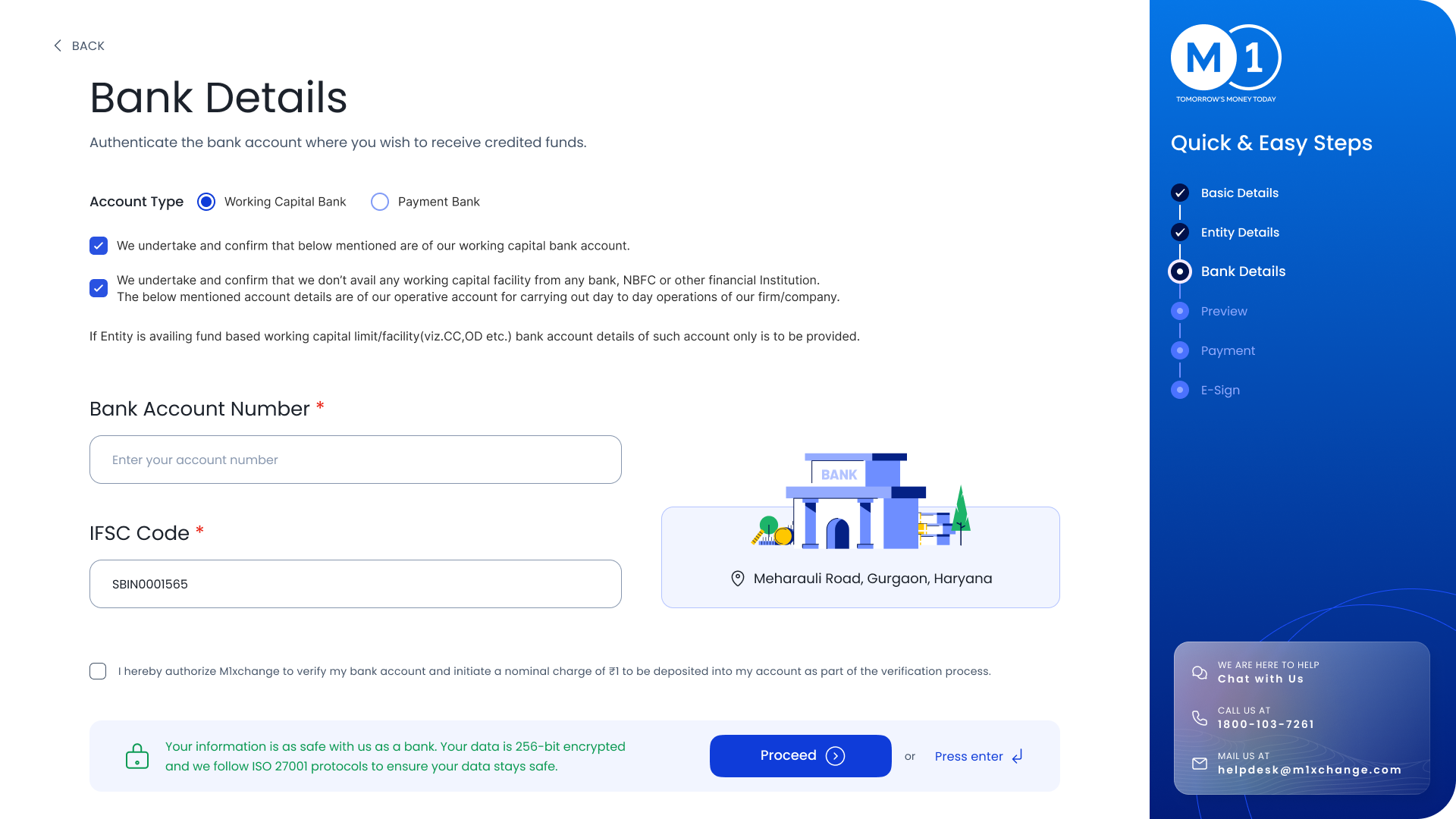

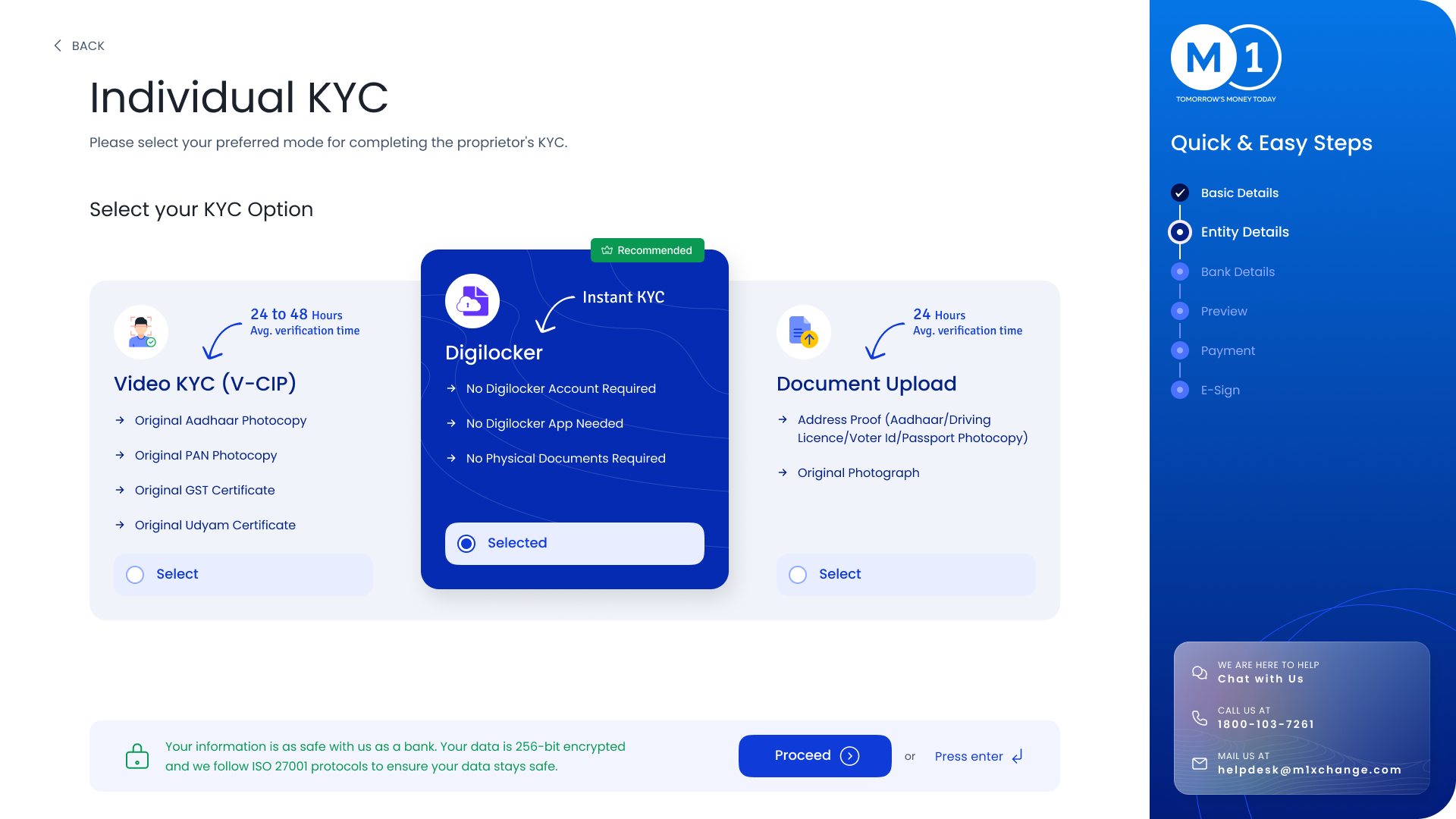

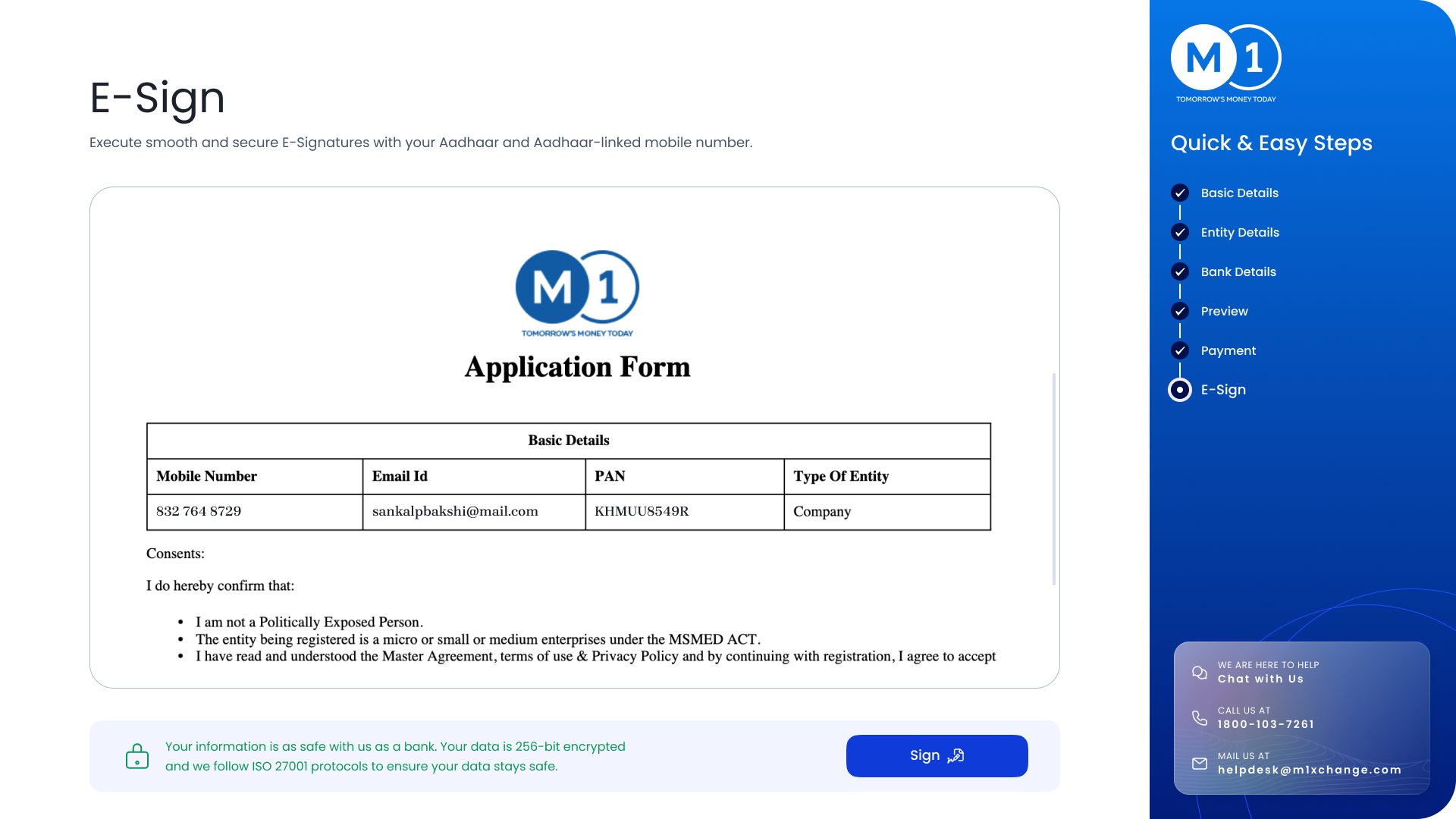

Digital onboarding process, including eKYC, video verification, e-agreement signing, documents submission, etc., is fast and convenient. The experienced team provide timely and abled support to fast track it.

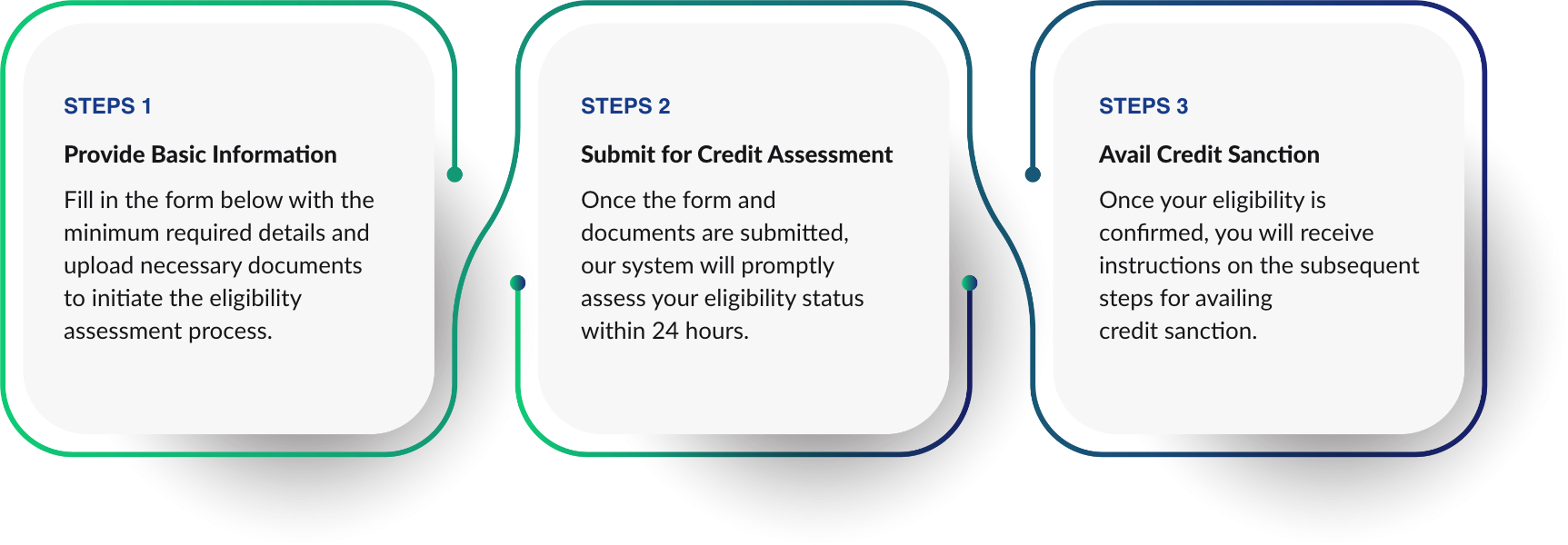

Through a credit analytics engine (CAE), the model offers digital credit assessment of MSMEs that leverages data available from multiple online data sources such as bank statements, GSTN, TReDS transaction data, etc.

Based on the approval of the transactions, the approved funds are disbursed to the vendors, providing them with quick access to working capital for their operations.

Buyer repay the funds when the payment is due, creating a seamless and mutually beneficial financial cycle.

An eligible buyer is an existing M1xchange vendor with a history of activity in the last 6 months. The vendor should be an MSME with a turnover ranging from > Rs. 5 crore to less than Rs. 250 crore.

Interest rates range from 11% to 14% p.a., varying among banks. Processing fees fall between 1% and 2%, contingent on the sanctioned limit.

Credit limits are sanctioned based on documents, bank statements, and consent for GST and CIBIL data provided during onboarding. M1xchange facilitates the limit sanctioning process using an in-house credit analytics engine.

Limits can be sanctioned from Rs. 10 lakhs to a maximum of Rs. 100 lakhs. Financiers may consider higher limits based on their comfort.

Documents needed are those collected during TReDs onboarding, including additional bank statements, GST data via OTP, CIBIL data with consent, and audited financial reports for the last 2 years. The sanctioning process may take up to 5 working days once all lender documentation is complete.

Yes, the process mirrors TReDs, covering onboarding, transactions, funding, and settlement. Each buyer is associated with one financier for funding transactions on the TReDs platform.

The maximum credit period offered is up to 60 days. Banks may consider extending it to 90 days if deemed comfortable with the buyer.

Copyright © 2024 Mynd Solutions Pvt. Ltd. All Rights Reserved.