MSMEs contribute to 37% of the total GDP of the nation and play a vital role to uplift the Indian economy. Despite being the backbone of the Economy, MSMEs often struggle in garnering optimal working capital and smooth cash0flows, one of the big reasons being the slow-paying invoices. To help MSMEs combat this problem the government introduced the concept of TReDS (Trade receivable Discounting System).

What is TReDS?

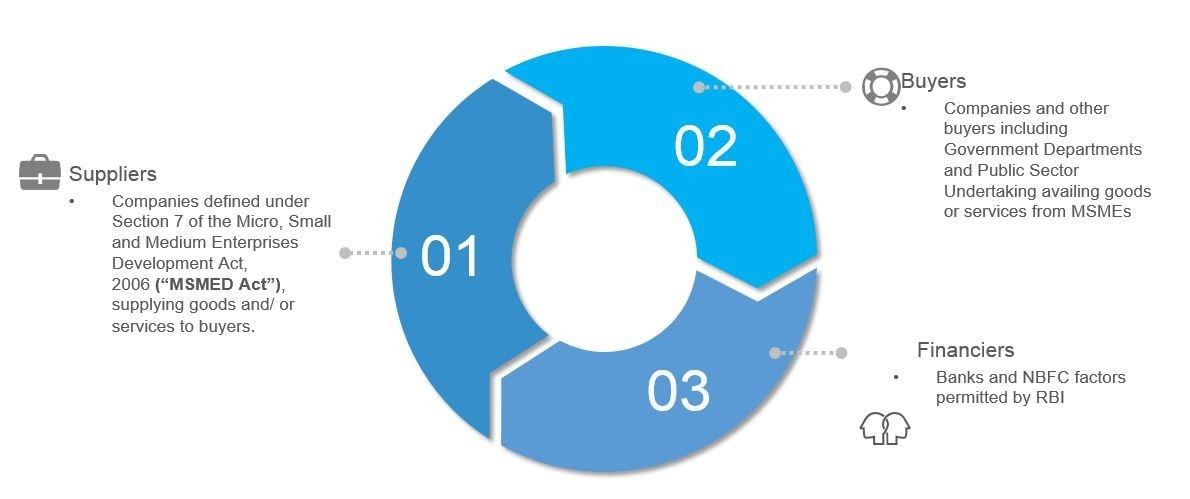

TReDS is an electronic platform that allows businesses to auction trade receivables such as invoices, and the platform serves as a transparent and quick medium for the MSME vendors to avail funds at cheaper rates through banks and factoring companies. It involves a digital mechanism having 3 stakeholders, the corporate buyer, the MSME supplier, and the financier. The MSME supplier uploads an invoice on the M1xchange platform which is approved by its buyer. On approval, the invoice is opened for bidding by various financiers on the platform. Once the MSME accepts the best-suited bid, the discounted amount is credited to the MSME’s bank account on the next day of bid acceptance. This gives MSMEs quick access to working capital at a very low rate of interest.

Being a completely digital platform the transactions are 100% transparent and the overall administration cost for vendor financing, payments, and settlements are significantly reduced lowering the overall cost of a trade.

Key Participants in TReDS

Key Benefits for MSMEs

TReDS helps a supplier to realize payment against an invoice raised to a buyer, through a financier at discounted rates, in significantly less number of days as compared to the buyer company’s regular credit period timelines. Here are some of the key benefits of TReDS for MSMEs

- Get easy and quick working capital at much cheaper interest rates as compared to business loans.

- Enjoy collateral-free quick finance with one-time documentation

- Get paid for your invoices the next day after acceptance of the discounted amount.

- Obtain off-balance sheet finance, the amount does not reflect as a loan in your balance book.

- Maintain a regular cash flow with M1xchange and grow your business

In the words of the Prime Minister “Joining this portal will enable entrepreneurs to access credit from banks, based on their upcoming receivables. This will resolve their problems of the cash cycle.” This development will enable the Suppliers to use the facility of M1xchange, as the corporate buyers and PSU’s will be mandatorily onboarded on the exchange. This compliance will practically accelerate the availability of working capital finance for MSME suppliers.

In simpler words, TReDS helps a supplier to realize payment against an invoice raised to a buyer through a financier at discounted rates in significantly less number of days.

TReDS is a game-changer. The benefits include quick turnaround, and lower finance costs owing to digitized information.

The Government Push

On the 2nd of November, 2018 the Ministry of MSME issued a notification to the organizations having an annual turnover of over Rs 500 crore. In the notification, the ministry has made it mandatory for such companies to register themselves on an RBI approved TReDS platform. Registrar of Companies (ROC) in each state for companies and CPSEs has been granted the authority to implement and monitor the above instruction.

Recently, the Institute of Company Secretaries of India (ICSI) has received a communication from the Ministry of Corporate Affairs (MCA) to advise Company Secretaries of such companies to ensure registration of such companies on the TReDS platform at the earliest and confirm compliance.

Currently, there are three TReDS platforms in India that are operating under RBI guidelines.

- M1xchange

- A.Treds

- Receivable Exchange of India

Among the three platforms, M1xchange is leading the TReDS sphere and has emerged out to be the biggest and fastest-growing TReDS platform in terms of Volumes of Bills Discounted. The exchange has a robust digital platform and excels in customer service. The platform has also won two prestigious awards for its overall contribution to the MSME sector, Best Digital Solution of the year by Indian Express in December 2017 and Best Payment Technology Solution provider by ET now in February 2019