INDIA’S TOP Consumer Electronics Manufacturer Enables Instant Working Capital for Its Vendors With TReDS

CLIENT OVERVIEW The client operated in consumer electronics manufacturing – Lighting, home appliance, mobile phone segments, and...

Working Capital Finance – A Perfect Way To Improve Your Supply Chain

The sound financial foundation and the routine operational performance of a firm are determined by efficient working capital finance. Its...

A Perfect Cash Flow Management with Invoice Financing

Introduction: Cashflow Management Of MSMEs The process of measuring, monitoring, and optimising the number of net cash receipts minus the...

An Ultimate Guide To Seamless Digital SME Finance In India: 2023

SME’s in India The Ministry of Micro, Small & Medium Enterprises considers the MSME sector to have excellent growth potential and...

Accelerate Your Business Growth with Invoice Financing

Due to a lack of supply from traditional financing sources, invoice financing is becoming a more popular approach for MSMEs to enhance...

Tips to Overcome Working Capital Crunch for The Growth of MSMEs in India

About MSMEs Themicro, small & medium enterprises development (MSMED) Act, 2006 categorizes micro, small and medium enterprises into two...

India’s Leading Automotive Components Manufacturer

OVERVIEW Our client is a leading automotive components manufacturer with manufacturing facilities in India and abroad. In the three decades...

India’s top Spice Exporter Enables Instant Working Capital for Its Vendors with TReDS

Client Overview The client is a successfully run spice manufacturing and exporting company with its roots embedded in India. The company...

Solving the Late Supplier Payment Problem

Late payment, even non-payment, of dues to the MSME sector is rampant. This increased manifold when the Covid crisis hit the economy. To...

Supply Chain Finance Bridging the Gap of Funding for MSMEs

What is Supply Chain Finance (SCF)? The tech-based integrated solutions that help bring down financing costs while raising the efficiency...

Know-How The Indian Economy Benefits From Digital Invoice Discounting

Invoice discounting is the practice of using a company’s unpaid accounts receivable as collateral for a loan, which a finance company...

Invoice Factoring Services – Funding advantages over a Business Loan

In the past, taking out a bank loan was the most common way to get business financing. However, in recent years, banks have become more...

TReDS emerged as digital lifeline for Covid hit MSME, Banks and Corporations

The financial stability report released by the Reserve Bank of India has cautioned banks of the possibility of increasing default by the...

TReDS – The MSME Shield Against COVID-19

The second wave of Covid came at a time when the MSME sector was gradually recovering from the cataclysm that had hit the economy in 2020....

Accounts Receivable Financing – A Lane Better Than SME Loans

Many small and medium businesses operate through a credit system to keep up goodwill with their customers. However, if 9 out of 10...

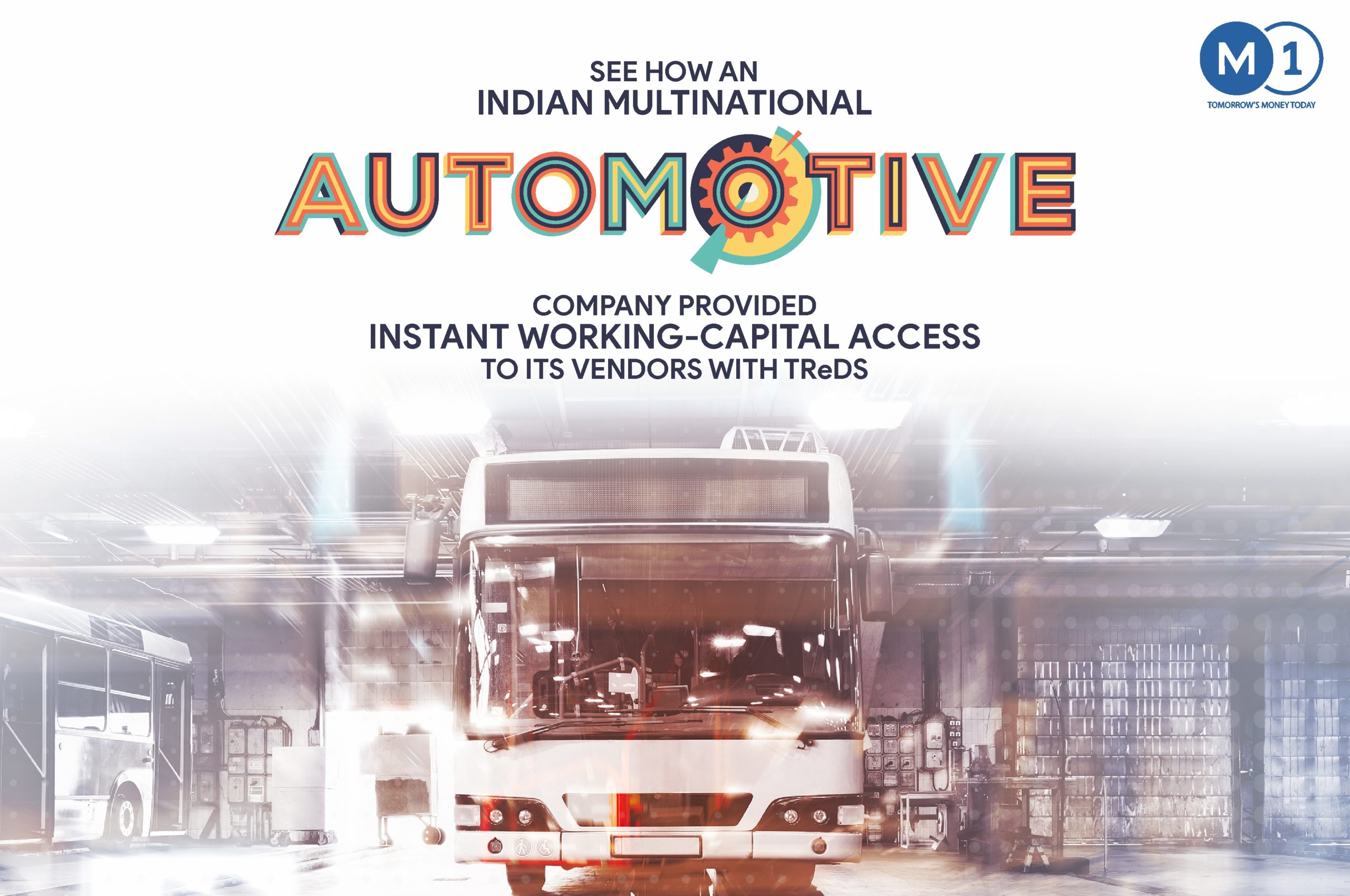

See How An Indian Multinational Automotive Company Provided Instant Working Capital Access To Its Vendors With TreDs

Our client is an Indian multinational automobile market leader in the bus segment, and the third largest manufacturer of buses in the...

Building Atmanirbhar India one transaction at a time

India has around 6.3 crores registered Micro Small and Medium Enterprises (MSMEs) and reports indicate that the sector grew 18.5%...

Supply Chain Financing: Gift to Buyers and Suppliers

All businesses are on a constant lookout for innovative ways to lower their financing costs and improve their business efficiency. And in...

How Can TReDS help MSMEs beat COVID-19 downturn

With almost all major economies of the world struggling, at standstill, and grappling due to the COVID-19 pandemic, most organizations are...

MSMEs: The new age catalyst for the Indian Economy

The Indian economy has portrayed itself as a developing market. The promise of long-term growth is positively owned by the country’s...