On 2nd November 2018, the Ministry of MSME issued a special notification to all organizations with an annual turnover of Rs. 500 crore and more. In the notification, the ministry made it mandatory for such companies to register themselves on an RBI approved TReDS platform. Registrar of Companies (ROC) in each state and CPSEs has also been granted the authority to implement and monitor compliance to the above instruction.

Recently, the Institute of Company Secretaries of India (ICSI) has also received a communication from the Ministry of Corporate Affairs (MCA) to advise the Company Secretaries of such organizations to ensure registration of such companies on the TReDS platform at the earliest and confirm compliance.

What Is TReDS?

TReDS (Trade Receivable Discounting System) is an institutional mechanism that allows businesses to auction trade receivables (Invoices) on a digital platform. The platform serves as a transparent and quick medium for the small scale players to avail very quick disbursement of their payments, through banking and factoring companies, at extremely reasonable bill-discounting rates.

Benefits For MSMEs

TReDS helps a supplier to realize payment against an invoice raised to a buyer, through a financier at discounted rates, in significantly less number of days as compared to the buyer company’s regular credit period timelines.

- It involves three parties (suppliers, buyers, financiers) and the whole process of invoice discounting takes place on a digital platform.

- The process of bill discounting initiates with the uploading of a valid invoice by the supplier on the TReDS platform and the buyer then checks the validity of the invoice &approves the same.

- Upon approval, various financiers start to bid on the invoice at discounted rates (that depends on the buyer’s rating).

- The supplier then accepts the bid as per their discretion, upon acceptance, the payment is processed the next day, and the supplier’s account is credited with the discounted amount.

Benefit For Corporates

The same process which helps MSMEs get faster payments at a discounted cost is the one that enables corporates get multiple benefits too.

Extended Payment Cycles

The payment cycle decided during the contracts is usually limited to 45 days. But with the reverse-factoring feature on TReDS, corporates can extend their payment cycle period through a financer, while ensuring that the vendor gets paid on time. This helps corporates maintain a healthy vendor relationship with the relief of the payment cycle.

Reduced Exceptions

Another indirect benefit is the factoring process of vendors. When a vendor applies for factoring, they get their payment at discounted rates much faster than the designated time period, and without the corporate getting involved. This removes the chance of exceptions like an early payment that vendors often demand from corporates.

Improved Working Capital

The discounting feature also helps corporates put the working capital to use based on priority. Whether the vendor opts for discounting or the corporate opts for reverse discounting, the payment time extension enables better management of working capital.

Better Negotiations

As a buyer, negotiation plays an important role in improving the business’ financial health. When vendors get the confidence of assured timely payments through a single platform with a reduced payment cycle, the vendors will automatically be quite happy to supply their goods & services for the buyer organization, and give it preference in delivery timing, and even be able to handle larger order sizes. All of this creates a better negotiation scenario for the corporates as a buyer.

Conclusion

Even though the direct benefits of TReDS appear to be for the vendors, in the long-term corporates benefit significantly through savings in the form of working capital relief, extended payment cycles, better business cost visibility, and improved vendor relationships.

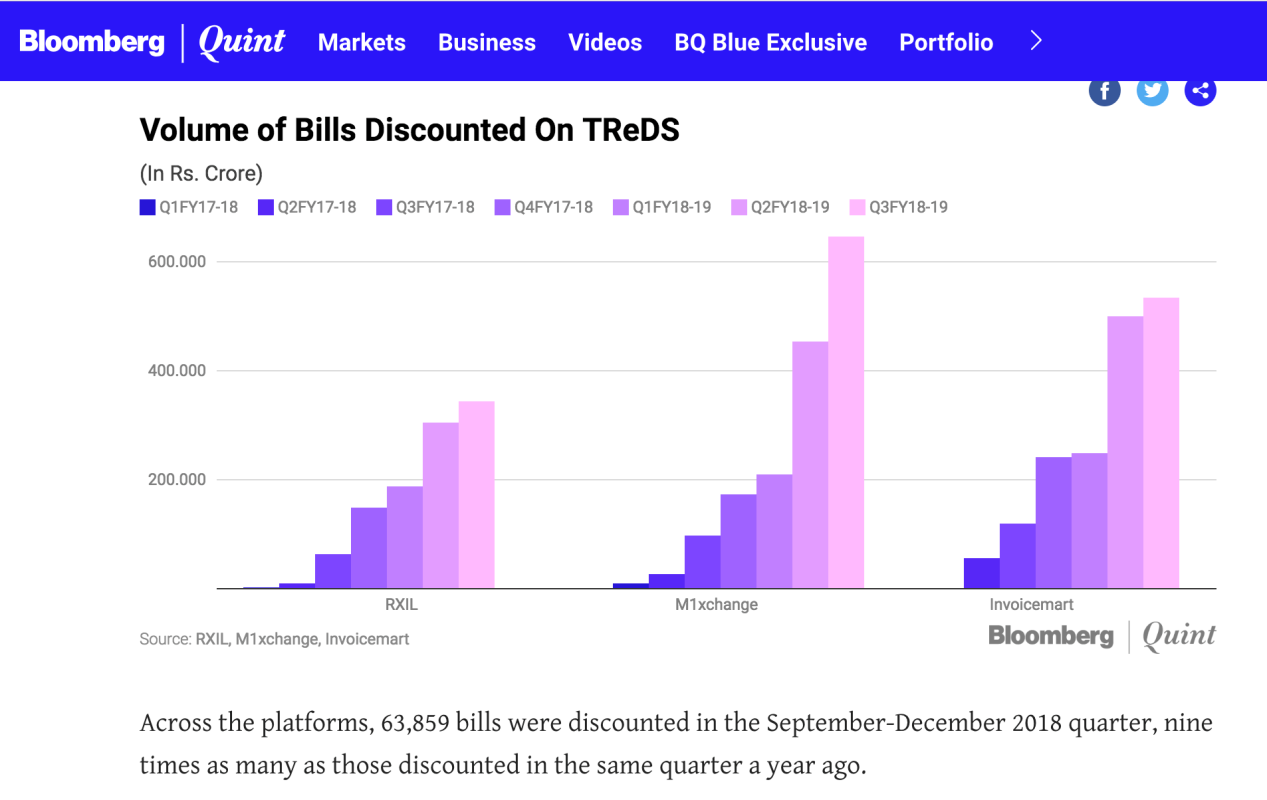

Currently, there are three TReDS platforms in India that are operating under RBI guidelines:

- M1xchange

- Invoicemart

- Receivable Exchange of India Ltd. (RXIL)

Among the three platforms, M1xchange is leading the TReDS sphere and has emerged as the biggest and fastest-growing TReDS platform in terms of Volume of Bills Discounted. The exchange has a robust digital platform and excels in providing great customer service. The platform has also won 2 prestigious awards for its overall contribution to the MSME sector – Best Digital Solution of the Year by Indian Express in December 2017 and Best Payment Technology Solution Provider by ET Now in February 2019.

To conclude, no matter which TReDS platform you register on – as a corporate buyer or MSME supplier, or financier – you are going to reap multiple benefits. This is a huge step that will change for good the face of business transactions in India in the very near future itself.

Click here to download the article PDF

Also read these – Working capital financing, SME Finance, Invoice Financing, Accounts Receivable Financing, Supply chain financing. Factoring Services

Last modified: November 27, 2024