All businesses are on a constant lookout for innovative ways to lower their financing costs and improve their business efficiency. And in the last few years, no other financing technique has impacted businesses, as much as Supply Chain Finance.

Popularly called SCF, Supply Chain Financing is a technology-based financing solution that links the buyer and seller and helps a business transaction. In the last few years, it has become very popular and positively impacted the business transaction between the suppliers and the corporates, making the transaction efficient. And that’s not all, it provides an easy way of business financing as well.

How does Supply Chain Finance work?

SCF technique makes use of technology to automate the entire transaction, right from invoice approval to its settlement. The system comprises three parties- the supplier, the corporate buyer, and the financing institution.

The process starts when a corporate buyer purchases some goods or materials from a supplier and promises to make the payment anything between 30 to 60 days. However, all suppliers want to have a payment cycle as short as possible, so that they can manage their working capital requirements. In such cases, if they have the invoices approved by the corporates, they can get instant payment for the invoice generated by them.

Now, the buyer has two ways of paying the suppliers. These are:

• Factoring– a form of Receivables Purchase, in which sellers of goods and services sell their receivables (represented by outstanding invoices) at a discount to a finance provider (commonly known as the ‘factor’).

• Reverse factoring– also known as supply chain finance or supplier finance, is a financial technology solution that supports its suppliers by financing their receivables, where a bank pays the supplier’s invoices at an accelerated rate in exchange for lower rates, thus lowering costs and optimizing the business for both the supplier and buyer.

Benefits of Supplier Chain Finance:

The supply chain finance benefits both the parties – the supplier and the buyer corporate. While the supplier gets quick payment, the corporate gets an extended credit period. Both parties can use the cash in hand for other activities, without blocking their current assets.

Benefits to the Corporates:

1. Reduces investment in working capital to bare minimum

2. Automation reduces administration cost

3. Reduces overall cost of borrowings

4. Improves the credit rating of the corporate

Benefits to the Suppliers:

1. Shortens the Working Capital Cycle

2. Reduces the total value of invoices outstanding

3. Get benefits of lower financing rates

4. Improves cash flow

5. Reduces cost of financing by leveraging buyer’s credit rating

The Supply Chain Finance Process:

1. Supply Chain Finance is a financial agreement between a buyer and the supplier

2. The supplier, after supplying the goods or services to the seller, raises an invoice in the name of the buyer

3. The supplier uploads the invoice to the financer’s Supply Chain Finance platform

4. The Buyer approves the invoices on the same platform

5. Financer discounts the invoice and makes the payment to the supplier against the said invoice

6. At the time of maturity of the invoice, the financer debits the amount from the buyer’s account.

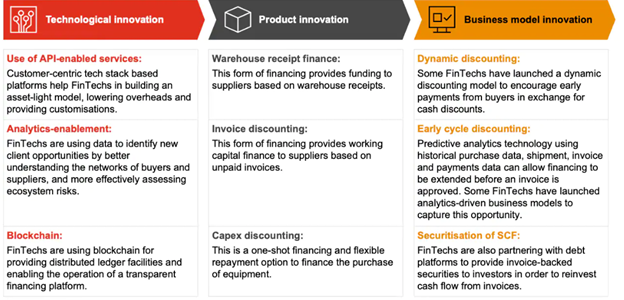

Innovations in the Supply Chain Financing Ecosystem

M1xchange App makes access easier for Supply Chain Financing

| Fast |

| •Instant access on the go •Invoice & bid acceptance on your fingertips •DOA acceptance in just a few clicks |

| Convenient |

| •Best-in-class user interface •Easy access to transaction summary •Expert helpdesk just one click away |

| Advanced |

| •Aadhaar based e-sign to authorize transactions •Notification for all important updates |

A business, however big or small always needs working capital to fund its daily expenses. The Supply Chain Financing facility from M1xchange helps both, the suppliers and the buyers. The suppliers get a quick payment for their invoice, while the buyers get more time to repay the money. This facility can be availed by all companies including public and private limited companies, sole proprietorship, partnerships, and limited liability companies by simply partnering with a Supply Chain Financing company like Mynd Solutions that acts as an intermediary between your company and your suppliers.

M1xchange from Mynd Solutions offers innovative financing options, such as invoice finance and supply chain finance, for SMEs to manage their cash resources and invest in growth.

M1xchange TReDS is a digital marketplace to sell the receivables to banks/NBFC set up under the approval of the Reserve Bank of India (RBI) to facilitate the discounting of invoices and bills of exchange on a PAN India basis.

Also read these – Working capital financing, SME Finance, Invoice Financing, Accounts Receivable Financing, Supply chain financing, Factoring Services

Last modified: August 29, 2023