On the 2nd of November, 2018 the Ministry of MSME issued a notification to the organizations having an annual turnover of over Rs 500 crore. In the notification, the ministry has made it mandatory for such companies to register themselves on an RBI-approved TReDS platform. Registrar of Companies (ROC) in each state for companies and CPSEs has been granted the authority to implement and monitor the above instruction.

Recently, the Institute of Company Secretaries of India (ICSI) has received a communication from the Ministry of Corporate Affairs (MCA) to advise Company Secretaries of such companies to ensure registration of such companies on the TReDS platform at the earliest and confirm compliance.

However one needs to first understand what is TReDS? Why is the Government pushing so hard to get it implemented? Do only MSMEs and big corporations need to register on TReDS?

TReDS (Trade Receivable Discounting System) is an institutional mechanism that allows businesses to auction trade receivables (invoices) on a digital platform, and the platform serves as a transparent and quick medium for the small scale players to avail funds at cheaper rates, through banking and factoring companies.

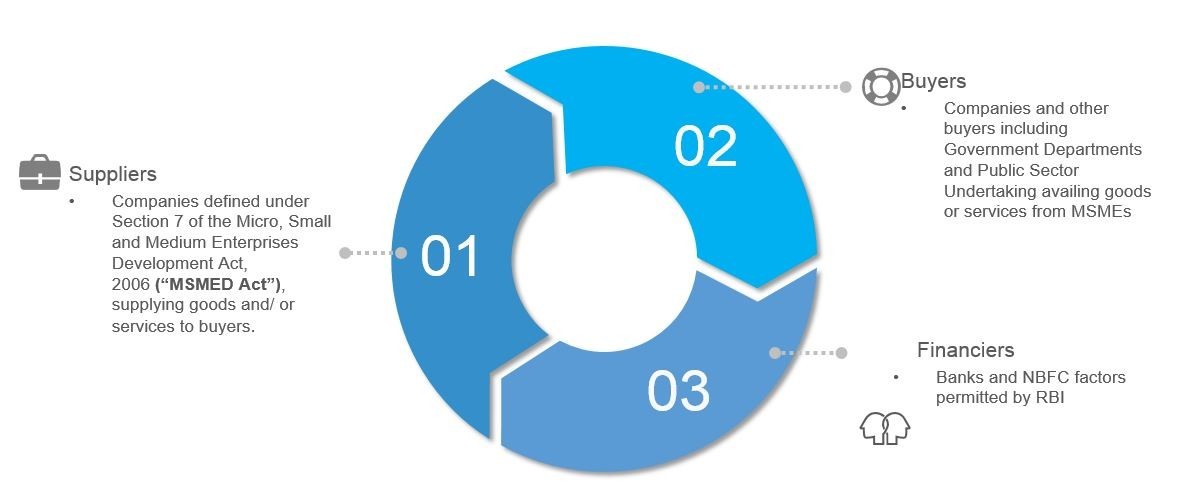

If I have to keep it simple, I would say that TReDS helps a supplier to realize payment against an invoice raised to a buyer through a financier at discounted rates in significantly less number of days. It involves three parties (suppliers, buyers, financiers) and the whole process of invoice discounting takes place on a digital platform.

So, was introducing TReDS in India really necessary? Or it is just a political gimmick. The truth is, TReDS is a boon for the Indian MSME sector. MSMEs contribute towards 8% of the total GDP of our nation, yet it is one of the most cash-starved sectors and often finds it difficult to acquire adequate working capital to grow. TReDS is a game-changer. The benefits include quick turnaround, and lower finance costs owing to digitized information.

Participants on a TReDS Platform

The process of bill discounting initiates with the uploading of a valid invoice by the Supplier on the TReDS platform, the buyer then checks the validity of the invoice approves the same. Upon approval, the financiers start to bid on the invoice at discounted rates which depends on the buyer’s rating. The supplier then accepts the bid as per their discretion, upon acceptance payment is processed the next day, and the supplier’s account is credited with the discounted amount. The process gives flexibility to the suppliers to choose the best financier on financing cost.

The process of Factoring on a TReDS Platform

Coming to the overall benefit of this system. Suppliers enjoy collateral-free without recourse financing at a rate much lower than a bank loan. The corporate buyers, on the other hand, get an extension on days payable helping them better manage their working capital. Since the corporates are enabling their MSME supplier to get paid in a matter of a few days, they are in a comfortable position to negotiate on the overall cost of procurement. Financiers are able to build a quality PSL Asset portfolio in the MSME space with a reduced risk of default.

Currently, there are three TReDS platforms in India that are operating under RBI guidelines.

1. M1xchange

2. A.Treds

3. Receivable Exchange of India

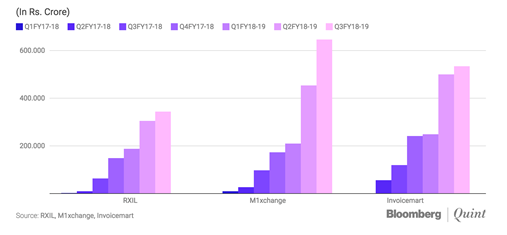

Among the three platforms, M1xchange is leading the TReDS sphere and has emerged out to be the biggest and fastest-growing TReDS platform in terms of Volumes of Bills Discounted. The exchange has a robust digital platform and excels in customer service. The platform has also won two prestigious awards for its overall contribution to the MSME sector, Best Digital Solution of the year by Indian Express in December 2017 and Best Payment Technology Solution provider by ET now in February 2019

Snapshot of an independent survey done by Bloomberg Quint depicting volume of transactions done in INR on each TReDS Platform

To conclude, no matter which TReDS platform you register, as a Corporate buyer or MSME supplier or Financier you are going to reap benefits from it. It will change the face of MSMEs and will revolutionize the way MSMEs do business in India.

Click here to download the article. TReDS- Game changer for MSMEs or just a gimmick

About the author:

Shivam is a seasoned marketing professional and currently enjoys the role of Marketing Manager at Mynd Solutions. He takes care of the overall marketing activity of M1xchange, the TReDS platform by Mynd Solutions, and the Finance & HR Outsourcing arm of Mynd Integrated Solutions. Shivam comes with over eight years of experience in Sales and Marketing and has an advertising agency background. He has worked with corporate biggies like Redington MEA, Transsion Holding, and DLF Brands.

Tags: bloomberg, MSME, RBI, Trade Receivables Discounting System, TReDS Platform Last modified: July 2, 2024

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.