Sample this. Since the onset of commercial operations in October 2017, M1xchange, an RBI approved Trade Receivables Discounting System (TReDS) platform, has been witness to Rs 1800 crore worth of transactions on its platform. On a similar trail, Invoicemart, a digital invoice discounting TReDS platform for MSMEs, discounted an overwhelming 1.4 lakh invoices amounting to Rs 2000 crore since its inception in July 2017.

In less than two years of operations, the electronic exchanges have been garnering a lot of interest from all the concerned stakeholders as a means to ease the fund flow for cash starved MSMEs.

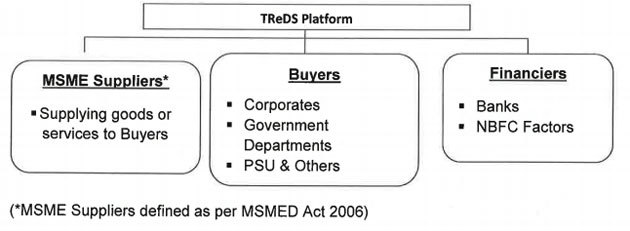

Billed as a platform that could help to address the credit woes of the MSME sector, TReDS eventually came through in 2017 with three players receiving RBI approved licenses for the platform. In a nutshell, TReDS allows MSMEs to receive money upfront which helps them to resolve their working capital problems, creating room for a more productive and financially sound business environment.

Receivables Exchange of India (RXIL), a joint-venture between National Stock Exchange and SIDBI; A Treds, a joint-venture between Axis Bank and Mjunction Services; and Mynd Solution that runs M1xchange are the three TReDS exchanges that exist at present.

How it plays out

So, how does it really pan out in terms of easing the financial constraints for small businesses? As a first step, the seller uploads the invoice on the platform and creates a factoring unit. This details out the invoice information in digital format and needs to be accepted by the buyer before it can be sent to financiers for the bidding process. The seller then chooses the most attractive bid and gets the funds from the financier within 48 hours. In the next phase of settlement, the outstanding amount gets paid back to the financier by the buyer on the due date of payment.

A buyer would typically mean a large corporate entity, seller refers to the MSME and the financier implies the bank or NBFC in this transaction.

Finding acceptance

Sundeep Mohindru, CEO of M1xchange says that the industry response to the platform has been heartening enough. “Till March 2018, it was mostly the private sector that was adopting it. Since April ’18, PSUs have started participating as well. Now large corporates, PSUs, private sector – they have started participating and are realising the power and the potential of it,” he says. Banks such as SBI, Bank of Baroda, PSU’s like ONGC, NTPC and MSME partners in the domain of agriculture, dairy and automotive are among some of the prominent names who have on-boarded with them.

Increasingly more players are coming into the fold as awareness and advantages of the platform play out. M1xchange has enrolled over 1000 MSMEs/Vendors, 100 corporates and 24 banks since it was launched. In step is Invoicemart which has 99 corporates and 1331 MSMEs so far on its platform. Kalyan Basu, MD & CEO, A.TReDs Ltd (Invoicemart) explains that this concept is a takeaway from Mexico’s Nacional Financiera (NAFIN) which facilitates the access of finance for SMEs and entrepreneurs with the objective of sustainable economic development in the country. “Former RBI Governor Raghuram Rajan was impressed with this idea and wanted to introduce it here. We plan to enhance the existing platform to make it more comprehensive in its service offering and ease the process of payments. We plan to reach a target of Rs 11,000 crore by 2020,” reveals Basu, upbeat about how the platform is set to pick up further momentum and pace in the near future.

Benefits unlocked

Mohindru calls it nothing less than a “God send” for MSMEs saying that they can capitalise on the many benefits that such exchanges offer. The rate of interest, for instance, can come down to 8-9% via the platform for an MSME as against 12-18% that accrues from traditional routes. “There is a 5-6% cost reduction for SMEs from the commercial model because bank is taking an exposure on a large corporate leading to a lowered interest rate. Secondly, if the large corporate does not pay or if there is a delay in payment, there is no impact on the MSME. The bank is buying the receivable from the MSME and takes over the risk from them. So if the corporate does not pay, it is between the bank and the corporate, not the MSME,” explains Mohindru.

Moreover, it helps in payments to MSMEs in a short period of time. Basu highlights how such a platform helps the seller in multiple ways. “It allows the seller many financiers to choose from and he is not restricted to any one financier that he visits. Also the entire process is paperless and that allows the seller to choose from various interest rates offered by the financiers on the TReDS platform. It is without recourse to the seller. This helps the seller to secure the best deal which would have been impossible in a traditional method of bill discounting,” he says.

Not all hunky dory

However, despite the range of benefits on offer, there have been hiccups. When it was launched, companies had expressed discomfort uploading invoices online as they thought it would make their MSME suppliers known to competitors. Mohindru, however, is quick to assert by saying that this issue was faced primarily in the early days of FY 2017-18 and settled in as corporates experienced ease of doing transaction at reasonable costs. “The volume of transactions on TReDS platforms as well as the volume of onboarding of large corporates reflects their confidence in the system,” he adds.

Newer challenges have sprung up since that time. For instance, since the time Aadhaar-based KYC has been stopped, the onboarding cost for TReDS platforms has increased. So one has to complete KYC physically for vendors from multiple locations in India and this ends up being more expensive.

For PSUs and corporates, Mohindru feels, the system has to evolve for approval of vendor invoices by PSUs in a shorter time frame from submission date.

Future forward

Experts feel that continual government support and awareness can go a long way in countering the challenges being experienced. The government on its part has taken several initiatives recently to boost the TReDS exchanges. All advances under TReDS are categorised as Priority Sector Lending for banks who participate, thus widening eligibility of MSMEs. In his 12 point agenda to spur growth and boost revival of the MSME sector last year, Prime Minister Narendra Modi had also made it mandatory for companies with a turnover of Rs 500 crore and above to join TReDS so that cash flow does not pose a deterrent to this sector.

Accordingly, TReDS exchanges too have taken cognisance of key aspects which can further improve efficiency and uplift the system. M1xchange, for example, will be linking this platform with GST this year thereby increasing the transparency and ensuring invoices generated are genuine. The expectation is to scale up to Rs 10,000 crore worth of business to be discounted on their platform from the current Rs 1800 crore by March 2020.

Next on agenda are educational programmes for both MSMEs and corporates to build more awareness about the various functionings of the system. Invoicemart also has plans to participate in the workshops organised by RBI to create awareness on TReDS among bankers and how it helps in financial inclusion of MSMEs.

The enthusiasm seems to have caught on going by the increasing numbers of players coming on board every other day on these platforms. As Mohindru puts it, “The TReDS programme is modernising and bringing up India. A huge shift has happened. Making it mandatory will only help in changing the style and the attitude.”

We are recently being covered by Economic Times