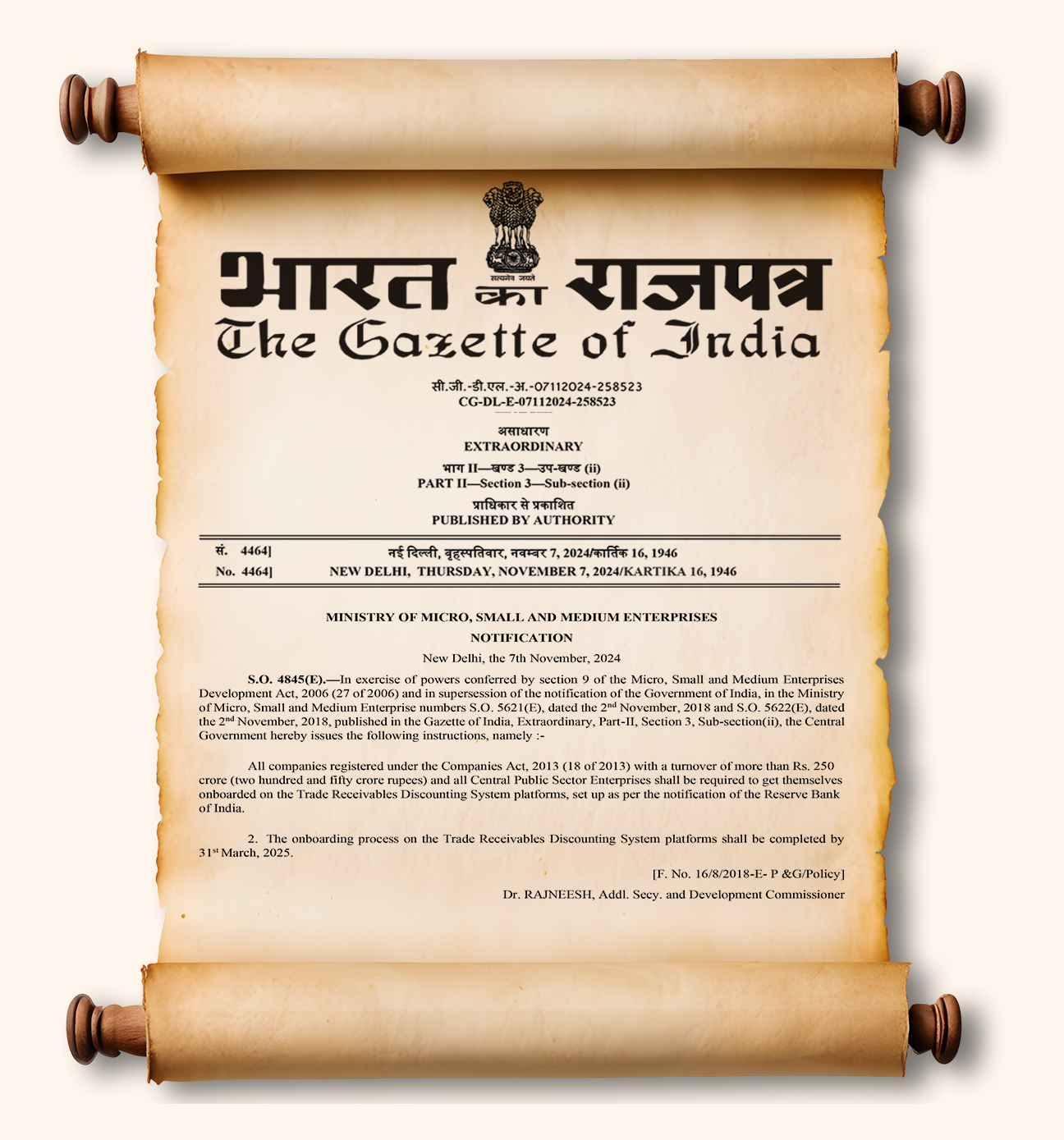

During Budget 2024 speech, Finance Minister Nirmala Sitharaman emphasized the importance of supporting MSMEs by making access to working capital more inclusive and efficient. She announced the reduction of the mandatory threshold for TReDS onboarding from ₹500 crore to ₹250 crore, allowing more mid-sized businesses to benefit from platforms like M1xchange TReDS.

“This adjustment is aimed at providing MSMEs with timely access to liquidity, which is crucial for their growth and financial stability. By broadening the scope of TReDS, we aim to enhance transparency, improve cash flows, and foster a healthier business environment for small and medium-sized enterprises across India,” Sitharaman said during her speech.

This regulatory move opens doors for more businesses to join M1xchange TReDS, giving them access to a secure and efficient platform that promotes liquidity, transparency, and better supplier relationships.

During Budget 2024 speech, Finance Minister Nirmala Sitharaman emphasized the importance of supporting MSMEs by making access to working capital more inclusive and efficient. She announced the reduction of the mandatory threshold for TReDS onboarding from ₹500 crore to ₹250 crore, allowing more mid-sized businesses to benefit from platforms like M1xchange TReDS.

“This adjustment is aimed at providing MSMEs with timely access to liquidity, which is crucial for their growth and financial stability. By broadening the scope of TReDS, we aim to enhance transparency, improve cash flows, and foster a healthier business environment for small and medium-sized enterprises across India,” Sitharaman said during her speech.

This regulatory move opens doors for more businesses to join M1xchange TReDS, giving them access to a secure and efficient platform that promotes liquidity, transparency, and better supplier relationships.

M1xchange TReDS is your gateway to faster payments and streamlined working capital. As India’s leading TReDS platform regulated by the RBI, we connect with a network of financiers to simplify invoice discounting and ensure efficient cash management.

Fill out the form below to begin your journey with M1xchange TReDS. Our team will guide you through every step of the onboarding process, making the transition smooth and seamless.

By facilitating timely payments to MSMEs, corporates can enhance their cash flow and reduce the risk of late payment penalties.

M1xchange can strengthen relationships with vendors by providing them with faster access to working capital, which can lead to improved supplier loyalty and performance.

By utilising M1xchange, corporates can effectively extend their days payable outstanding (DPO), which can improve their cash flow position and reduce the cost of borrowing.

For corporates with excess funds, M1xchange can offer opportunities to earn arbitrage income.

By facilitating faster payments to suppliers, corporates can reduce the cost of their working capital financing needs, as they may be able to negotiate better terms with their lenders.

The digital platform streamlines the invoice discounting process, reducing the need for manual paperwork and administrative overhead.

Copyright © 2024 Mynd Solutions Pvt. Ltd. All Rights Reserved.